Commodity Price Definition For Developers: From Market Theory To API Data

Ejaz Ahmed

4 Feb 2026 • 7 min read

Suppose we are creating a logistics dashboard or a fintech application. You have to determine the freight surcharge on crude oil. You also have to price gold-backed financial assets.

Then you know that price is not a fixed number. It changes all the time. International events drive it up or down.

This blog describes the commodity price definition technically. It also demonstrates the formation of prices in the international markets. We will relate the pricing theory to the API-based commodity pricing.

You will get to know how to deal with spot vs futures prices. You will also be taught how to add the real time data to your stack. By the conclusion, you will understand how to define commodity price for more robust data-driven applications.

Understanding The Technical Commodity Price Definition

Simply, the commodity price definition is the current financial worth attributed to a physical commodity or a standardized raw material. Commodities are fungible (interchangeable), unlike consumer goods. This implies that a barrel of crude oil would be treated similarly to another of the same grade.

The commodity price definition to the developers is more than that. It is a piece of data produced by a commodity exchange, like the CME Group. This price serves as a reference to the global economy. It is a measure of supply and demand at a particular time.

Component | Description | Developer Significance |

Spot Price | The market price now of instant delivery. | Use for real-time valuation. |

Futures Price | The price that is presently settled in the future. | Use for trend forecasting. |

Unit of Measure | T.oz, Bbl, MMBtu, etc. | Critical for UI/UX and calculations. |

Currency | Usually USD, but can be customized. | Requires conversion logic. |

What Determines Commodity Prices In Global Markets?

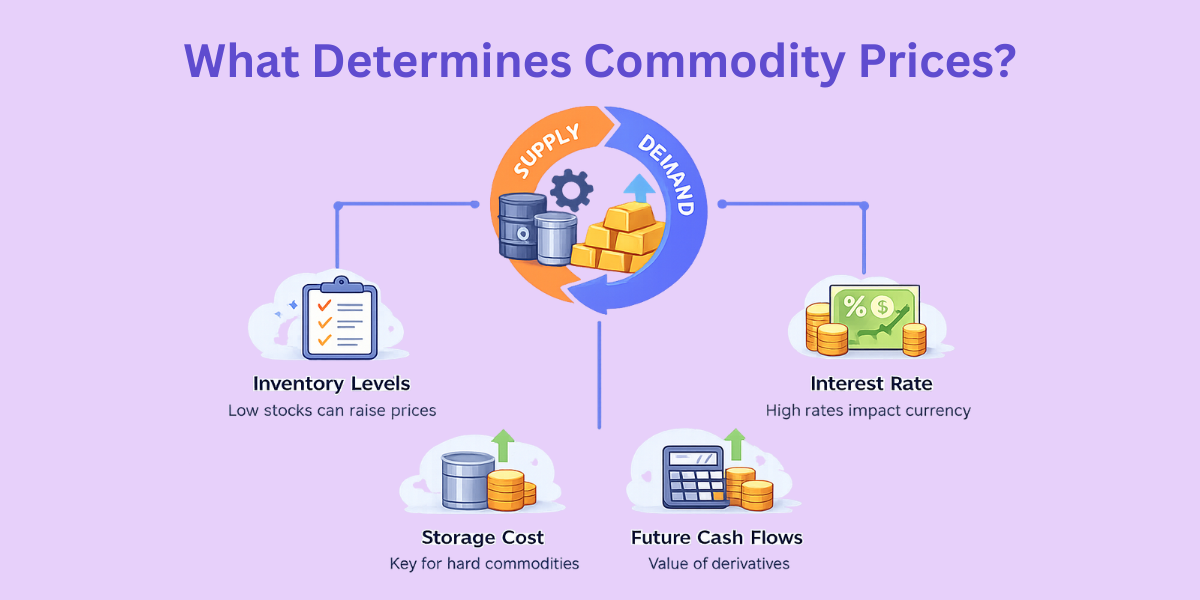

You may be questioned about what fixes the price of the commodities when you notice that the price on the dashboard has suddenly risen. Supply and demand pricing is the major factor. The process of market price formation is a combination of a number of other factors.

The basis is on supply and demand. In the event of a natural disaster or trade restrictions in the producing region, supply declines. Higher demand in a given industry may cause particular commodity prices to go high, shaping the commodity price definition.

In addition to supply and demand, there are investor sentiment and inflation hedge strategies. During volatile times in the stock market, institutional investors tend to transfer money to precious metals or energy commodities. This makes a number of commodities vulnerable to geopolitics and currency fluctuations.

Helpful Resource: How Traders Can Automate Commodity Alerts In Minutes

Key Factors Influencing Market Price:

- Inventory Levels: Low stocks normally result in a commodity price increase.

- Interest Rate: When the rate is high, it can strengthen a currency as it influences other commodity prices.

- Storage Cost: This is a key aspect of commodity price elements of hard commodities.

- Future Cash Flows: Investors determine the value of commodity derivatives with reference to these.

Spot Vs Futures Prices: The Developer’s Dilemma

It is important to remember that there is a difference between spot price and futures price when fetching data. A spot price is the amount you pay currently for a certain commodity. Commodity futures, on the other hand, are futures contracts to purchase or sell in the future.

The cost of carry is part of a futures price. This may cover storage expense and insurance. When constructing a tool on a diversified portfolio, you will probably be dealing with futures and options contracts and commodity price components.

The financial assets assist businesses in risk management. They safeguard against reduced physical commodity prices. They are also useful in dealing with price volatility related to the commodity price definition.

Oil prices have a reference point in the form of commodity benchmarks such as Brent or WTI. In the absence of these standards, the market price formation would be chaotic. To ensure that your data is intact as a developer, ensure that your API-based commodity pricing source is similar to the same commodity in various exchanges.

Categories Of Commodities Traded

To apply a clean commodity price definition in your database, you are advised to classify your symbols. The majority of commodities traded can be grouped into a few buckets:

- Energy Products: Consists of natural gas, crude oil, and other energy products. These are highly volatile.

- Metals and Energy Products: This frequently includes industrial metals with the precious metals, such as gold.

- Agricultural Commodities: These are frequently termed soft commodities. This covers the agricultural products such as wheat or corn.

- Hard Commodities: Hard commodities are usually the mined natural resources, like precious metals and minerals.

Implementing API-Based Commodity Pricing

Now, let's get practical. You should not scrape websites to obtain real-world commodity price data. Alternatively, a trusted commodity price definition service such as CommodityPriceAPI would be used. This guarantees you high-fidelity pricing mechanisms in commodities.

The following is a Python example of how to obtain the latest rates of energy products and precious metals. This code takes the market price information to provide you with a clear commodity price definition in your app.

Python

import requests

# Define your API key and endpoint

API_KEY = 'YOUR_API_KEY'

BASE_URL = 'https://api.commoditypriceapi.com/v2/rates/latest'

# Specify the symbols for gold, WTI oil, and natural gas

params = {

'apiKey': API_KEY,

'symbols': 'XAU,WTIOIL-FUT,NG-FUT',

'quote': 'USD'

}

def get_commodity_data():

try:

response = requests.get(BASE_URL, params=params)

data = response.json()

if data['success']:

rates = data['rates']

meta = data['metadata']

print(f"--- Real-time Commodity Price Definition ---")

for symbol, price in rates.items():

unit = meta[symbol]['unit']

print(f"{symbol}: ${price} per {unit}")

else:

print(f"Error: {data['error']}")

except Exception as e:

print(f"An error occurred: {e}")

get_commodity_data()Here is the output

--- Real-time Commodity Price Definition ---

XAU: $2034.12 per ounce

WTIOIL-FUT: $78.45 per barrel

NG-FUT: $2.31 per MMBtuWhy Use A JSON API?

- Accuracy: The information is obtained from the CME Group and other large exchanges.

- Speed: Receive 60-second updates in fast-moving global markets.

- Historical Background: Access to data since 1990 to learn the commodity pricing theory.

Helpful Resource: Top Benefits of Using a Commodity Data API for Real-Time Pricing

The Role Of Commodity Indices And Derivatives

A commodity index is a basket of underlying commodities. This assists institutional investors in observing general patterns. As an example, when the commodity index increases, it tends to indicate an increase in the price of the important raw materials.

These indices are used by developers to determine the health of a given industry. You can tell how investors feel in code by examining commodity derivatives and options contracts. This assists trading plans in responding to the market environment.

It is important since commodity markets are dynamic. The static commodity price definition is not sufficient. Live signals remind you that you need to be on point.

Managing Data Fluctuations And Errors

The prices fluctuate every second in the oil market or the natural gas industry. Your code must handle this. A hedge fund managing director is dependent on how your app can handle the demand dynamics.

Always have error handling in the API-based commodity pricing. Your system must fail gracefully in case of depreciation of a commodity symbol. It is supposed to give out a readable response and a secure fallback.

The /fluctuation endpoint will display the way the prices of physical commodities have changed in the past 24 hours. This provides a fast context for commodity price definition. It is also useful as it allows you to tell why and what changed.

Pro Tip: Currency fluctuations should always be considered when determining the future cash flows. The rise in the price of a commodity in USD may appear as a decline in EUR.

Helpful Resource: Detecting Commodity Price Fluctuations For Smarter Trading Decisions

TL;DR

- Commodity Price Definition: The value of exchangeable raw materials.

- Price Drivers: Driven by supply and demand, Geopolitics and inventory levels.

- Data Types: Distinguish between spot price and futures price.

- Tech Stack: API based commodity pricing using real-life commodity price data.

- Categories: Organize by hard commodities, soft commodities, and energy products.

Conclusion

The commodity price definition is the initial step of constructing advanced financial tools. We are now beyond the supply and demand dynamics and into the depths of commodity pricing theory. With a strong API, you can transform these theories into working code.

It does not matter whether you are monitoring precious metals in a diversified portfolio or you are monitoring gas prices in logistics; the quality of data is important. Integration of reliable market prices will enable your users to move in international markets comfortably. You have the tools now; it is time to build.

FAQs

What Determines Commodity Prices On A Daily Basis?

It is mostly supply and demand pricing, which is determined by inventory levels, geopolitical events, and investor sentiment.

Is The Spot Price The Same As The Futures Price?

No. The spot price is that of immediate delivery, whereas the futures price is that of a later date and involves the cost of storage.

Why Do Developers Need A Commodity Price Definition API?

The commodity price definition API offers a standardized and programmatic means of accessing the physical commodity data in global markets.

How Should Developers Handle Price Spikes Caused By Increased Demand?

Monitor inventory and supply indications. Monitor the market in real time. Introduce alerts on rising demand among market participants.

Why Do Mutual Funds And Other Market Participants Rely On Commodity Benchmarks?

Pricing is standardized by benchmarks. They decrease misunderstandings between exchanges. They also control trade policies within a given industry.

How Can A Dashboard Avoid Looking Like Investment Advice While Still Being Useful?

Show data with context, not predictions. Label insights as indicators, not investment advice. Let users build their own trading strategies from clean inputs.