Top Benefits of Using a Commodity Data API for Real-Time Pricing

Ejaz Ahmed

8 Dec 2025 • 7 min read

Introduction

Suppose you are managing a trading desk, and you see that the price of oil increases by 5% in a minute. But your system still shows the old price, and you make a decision based on that data. This problem affected the trader, supply chain managers, and developers around the world.

Do you know what the businesses need? They need real-time insights to stay competitive. This is why the API for commodity data is very important. They give instant access to the live and historical prices. You can easily track over 130 commodities, which include silver, natural gas, gold price API, crude oil, coffee API, and butter commodity.

APIs such as the CommodityPriceAPI give accurate, structured, and reliable data for dashboards, financial apps, or trading bots. In this blog, we will talk about what commodity data APIs are and why the pricing of real data matters. We will also see the benefits of integrating these APIs into your business. Let’s get started.

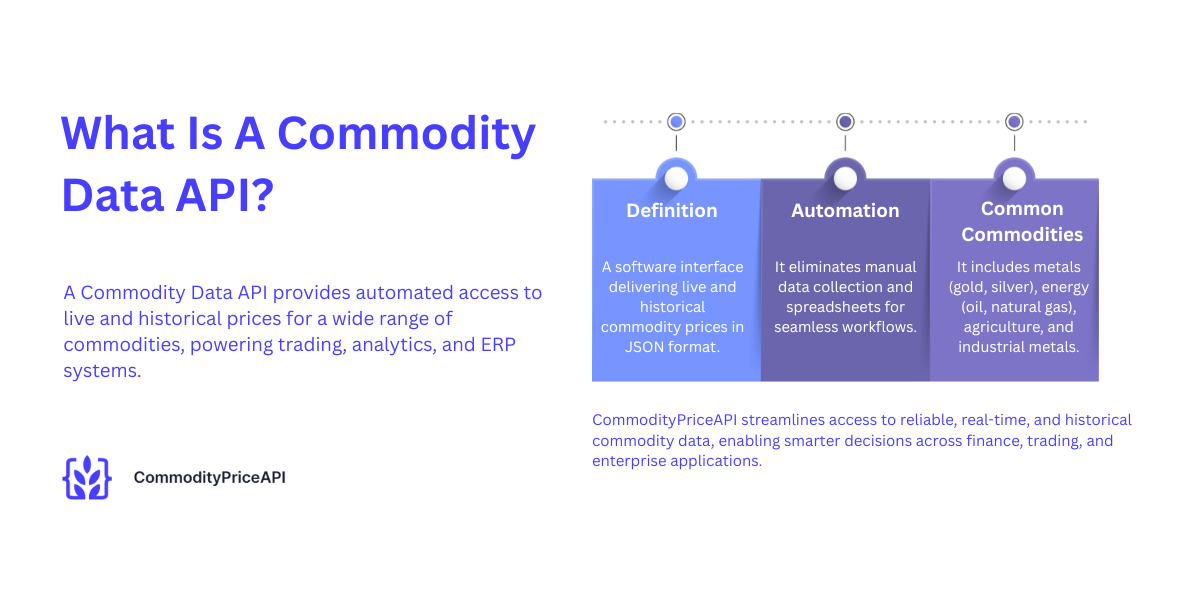

What Is A Commodity Data API?

A commodity data API is a software interface that gives you the latest and historical prices. Developers access that data in JSON format. Because of the API, you do not need the manual process. They support the automation in trading, analysis, and ERP systems.

Common commodities API free include:

- XAU, which means gold prices

- XAG, which means silver

- WTI, Brent, which means Oil

- Natural gas

- Agricultural crops

- Industrial metals

CommodityPriceAPI gives you these endpoints:

Endpoint | Description |

Latest Rates | They fetch current prices instantly |

Historical Rates | They access prices back to 1990 |

Time Series | They retrieve data over a date range |

Fluctuations | They track daily changes |

When you use this data, APIs save you time and reduce errors. Developers can integrate them easily into Python, JavaScript, Java, Node.js, or PHP projects.

If you want to learn about Gold price news, then read this blog, Latest Gold Price News: May 2024 Update.

Why Real-Time Pricing Matters Today

Nowadays, the market moves very fast. Prices change every second, impacting the trading strategies, managing your risks, and forecasting accuracy. Have you ever thought about that? If you use outdated data, it can lead to wrong decisions. Because of real-time prices, businesses perform well. It enabled automated trading bots, ERP updates, and live dashboards.

Financial apps depended on the latest rates for accuracy, and cost estimation. If real-time isn't available, companies risk:

- Delayed reporting

- Inefficient procurement

- Mispricing

API such as CommodityPriceAPI gives you the best solution. They connect the internal system to the latest market data, making sure that the decisions are informed, timely, and precise. Real time is very important for profitability and efficiency.

Top Benefits of Using a Commodity Data API for Real-Time Pricing

Instant Access To Live Prices

Commodity data APIs give you the prices of the market in seconds. Your application automatically pulls fresh data and eliminates the manual updates.

Example of JSON response:

rates: {

"XAU": 4146.18,

"WTIOIL-FUT": 58.66

}This gives you instant access, because these businesses stay with the market movements. Traders can easily respond to prices immediately. This gives benefits to the analysts; they feed live data into the dashboard. ERP and financial tools remain accurate and reduce risks.

Reliable And Trusted Market Data

Accuracy plays an important role. commodityPriceAPI sources the data from trusted exchanges and financial institutions. It reduces the error in trading strategies. Consistency is very important, they make sure better risk management and reporting.

Developers and analysts both trust the data for forecasting and automated workflows. Unlike web scraping and manual spreadsheets, APIs give you the best structured data, useful information. Because of this, you will make better decisions for yourself.

To know the information about the market landscape, read this blog: Navigate the Ever‑Shifting Market Landscape with CommodityPriceAPI.

Access To 130+ Commodities In One Place

CommodityPriceAPI covers 130 commodities, including:

- Precious metals

It includes gold, silver, and platinum

- Energy

It includes oil, natural gas, and coal

- Agriculture

It includes wheat and soybeans

- Industrial metals

It includes copper, aluminum, and zinc

Centralized access eliminates multiple vendor integrations. Developers save time and reduce complexity. Businesses can monitor diverse markets through a single API. This approach simplifies analytics and improves scalability for dashboards and apps.

Easy Integration For Developers

APIs give you simple REST endpoints. Developers can easily integrate it in just minutes by using any tech stack. Some of the supported programming languages are:

- Python

- JavaScript

- PHP

- Java

- Node.js

or any other backend language of your choice.

Example request:

https://api.commoditypriceapi.com/v2/rates/latest?symbols=XAU,WTIOIL-FUT&apiKey=YOUR_API_KEY

They give you responses in structured JSON format. These things allow immediate use in applications, BI tools, and dashboards. Documentation gives you full guidance; it makes your integration faster and straightforward, even for small teams.

Want to fetch real-time prices? Then read this blog of CommodityPriceAPI, How to Fetch Real Time Commodity Prices.

Custom Quote Currency Support

CommodityPriceAPI gives you support for 175+ currencies. Because of this, businesses are performing globally. They can easily convert prices into GBP, JPY, EUR, and their preferred currency. With the help of this feature, teams of multinationals can analyze the costs and profits accurately. It reduces the conversion errors and simplifies the reporting.

Plus and Premium plans give you live currency rates and other flexibilities.

Historical Data For Analytics

Historical prices are very important for trend analysis, machine learning, and forecasting. CommodityPriceAPI stores that data from the 1990s. Because of this, analysts can analyze long-term market behaviours, forecast future trends, and train predictive models

Example of endpoint:

/rates/historical?date=2024-11-10

Historical data support the accurate reporting, and they also support the risk assessment. They empower businesses to make better, more informed decisions.

Time-Series Insights

APIs give you querying, between one and two days. Time series data suits the:

- Economic modeling

- BI tools

- Dashboards

When businesses visualize these price trends from time to time. They can easily detect patterns and forecast future movements. Time series data enhances your decision-making process.

Monitor Daily Price Fluctuations

Fluctuations show you:

- End rate

- Start rate

- Percent change

- Utility Rate API changes.

- electricity rates API

Traders used this to evaluate the market. It supports dynamic pricing and risk management. Because of this, the analysis can quickly understand the abnormal trends and shifts.

Flexible Pricing With No Complex Contracts

CommodityPriceAPI gives you both monthly and yearly plans. The Lite plan is better for small projects. On the other hand, the Plus and Premium plans are best for application needs. Free trials are also available and help you in some cases.

Flexible pricing is best for businesses because businesses pay for what they use. There are no long-term contracts and hidden fees. It is easier to test for teams and developers.

Faster Decision-Making Through Automation

APIs are integrated directly into the internal tools. Businesses automate the price tracking, easily estimate the cost, and do procurement planning. Automation reduces the effort and errors. Companies gain a faster response within the given time.

Who Should Use A Commodity Data API?

The Commodity data API should be used by traders, financial analysts, and brokers. Why? Because they rely on accurate pricing. Teams of supply chains and companies of energy both need live commodity data or operations. SaaS platforms and agricultural businesses use APIs to power the apps and dashboards.

Developers are making dashboards and trading platforms. ERP integration benefits from reliable data. If any company or industry dealing with commodity prices data API wants to gain efficiency and accuracy. The Data is the best option.

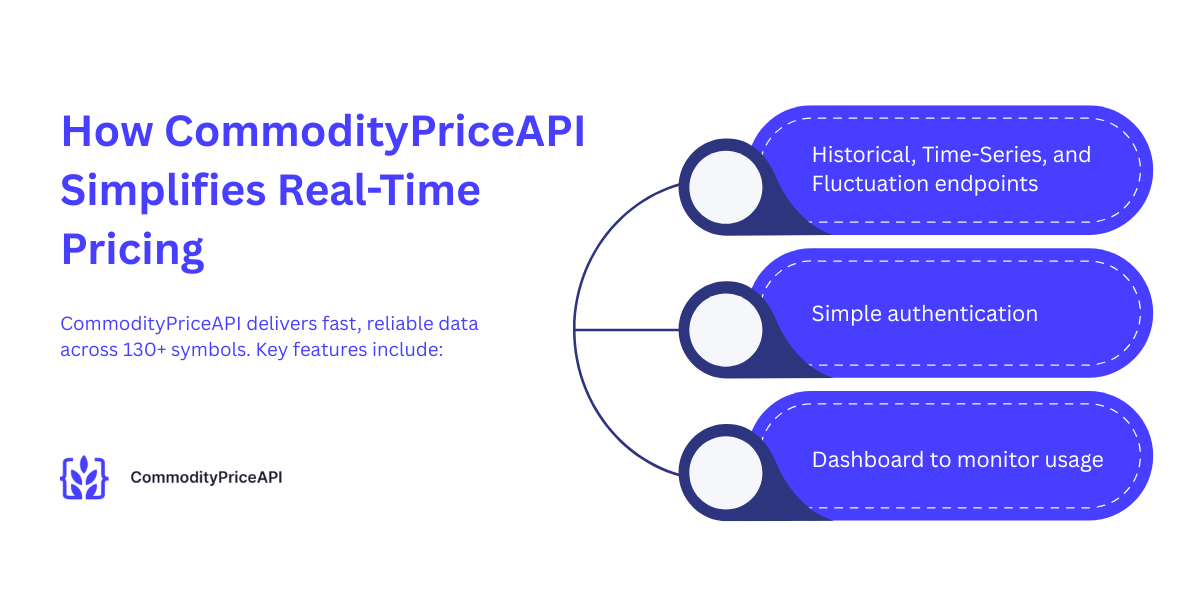

How CommodityPriceAPI Simplifies Real-Time Pricing

CommodityPriceAPI delivers fast, reliable data across 130+ symbols. Their key features include:

- They give you Historical, Time-Series, and Fluctuation endpoints

- They give you Simple authentication.

- Dashboard to monitor usage

With the help of this, developers can integrate it within minutes. REST endpoints support any tech stack. Real-time updates keep trading, analytics, and procurement accurate. Centralized access reduces vendor complexity.

2024 Commodity Prices Outlook: A Detailed Analysis

TL;DR

CommodityPriceAPI gives you the data in real time and historical prices for 130 commodities. Commodities include agricultural crops, natural gas, and gold. It supports the automation. It integrates easily into dashboards, trading platforms, and ERP systems through the REST APIs.

Because of this, developers get accurate and structured data in JSON format. It gives you flexible currency support and endpoints for historical data, time series, and fluctuations. Real-time pricing reduces errors and improves the process of decision-making. It enhances your operational efficiency. As a result, businesses save time.

CommodityPriceAPI has flexible plans, and they have a free trial, and offer faster integrations for traders, developers, analyst teams, and supply chain teams.

Conclusion

Real-time commodity pricing is very important for businesses in trading, finance, and supply chain management. Commodity data APIs simplify access to accurate and reliable data. They support automation, trend analysis, and operational efficiency.

CommodityPriceAPI gives you fast integration. They also give you extensive commodity coverage and flexible pricing. Stay ahead of market changes, reduce errors, and make smarter decisions.

FAQs

What Is A Commodity Data API?

The commodity API is a software interface that gives you the live and historical commodity prices in a JSON format.

How Does A Real-Time Commodity Pricing API Work?

APIs pull the data from trusted exchanges. They deliver it instantly to applications and the dashboards.

Which Commodity Data API Does CommodityPriceAPI Support?

Over 130 commodity data API, including:

- Gold

- Silver

- Oil

- Natural gas

- Agriculture

- Industrial metals.

Can I Get Historical Data For Gold, Oil, Or Natural Gas?

Yes, historical data gives you data from the 1990s.

How Often Are Prices Updated?

Updates can be every 60 seconds. It depends on your subscription plan.

Does The API Support Currency Conversion?

Yes, CommodityPriceAPI supports 175 plus commodity data API globally.

Is There A Free Trial Available?

Yes, the free commodities API gives you testing and integration.

How Do Developers Authenticate API Requests?

With the help of their API key, query parameters, and x-api-key.

Can I Integrate The API Into Mobile And Web Apps?

Yes, the API works with any tech stack. It also includes mobile and web platforms.

What Industries Benefit The Most From the Commodity Price Data API?

Traders, analysts, brokers, supply chain teams, energy companies, SaaS, and agricultural businesses.