Can Exchange Rates Forecast Commodity Prices? A Developer’s API-Based Approach

Ejaz Ahmed

10 Feb 2026 • 7 min read

Suppose that you are constructing a supply chain dashboard for a global coffee roaster. Then, suddenly, the Brazilian Real falls. The price of coffee goes up before your information is even updated.

You face a classic dilemma. What do you expect those changes to be? Can exchange rates forecast commodity prices, or are you simply chasing shadows?

In this guide, we shall discuss the currency-commodity relationship from a technical perspective. We will discuss the reason why some currencies behave like commodity currencies. We will also demonstrate how API-based forecasting can provide you with an advantage.

You will know how to draw data of CommodityPriceAPI for predicting global commodity prices. You will be analyzing the USD against the prices of commodities. You are going to create a predictive script.

We are transferring to code that is ready for production. The goal is to solve real-world volatility problems. A particular interest for teams building reliable systems under pressure. Also, many teams ask: Can exchange rates forecast commodity prices?

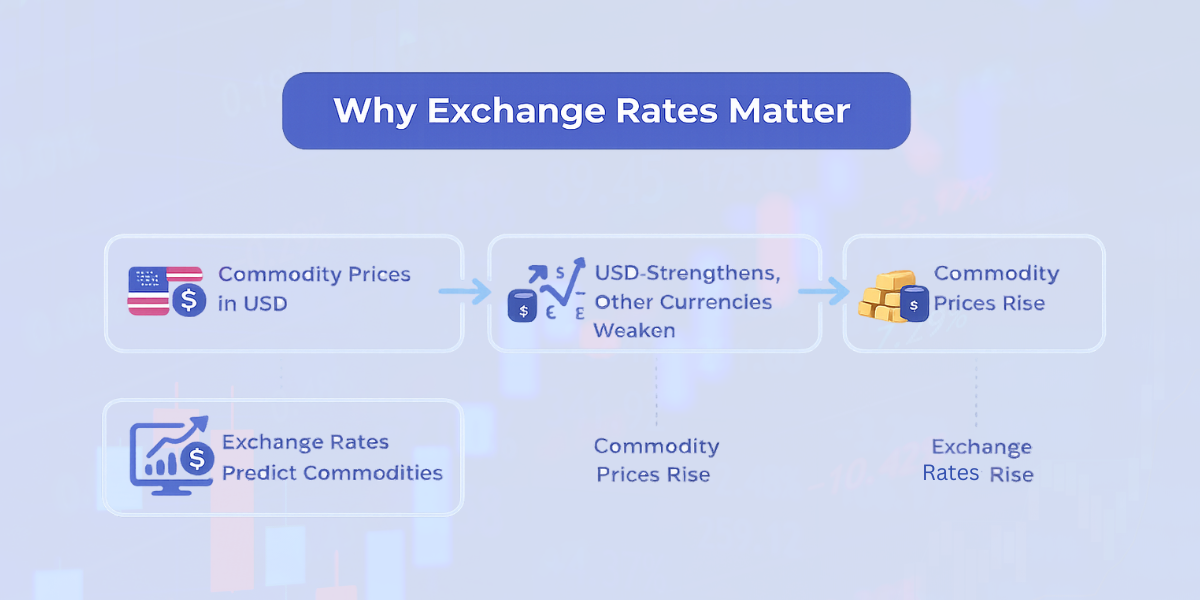

The Core Logic: Why Exchange Rates Matter

In order to determine whether exchange rates predict commodity prices, we need to consider global trade dynamics. The majority of world commodity prices are quoted in US Dollars (USD). The purchasing power of other currencies reduces when the dollar strengthens.

This generates an instant exchange rate impact on commodities. To a developer, this implies that exchange rates are not some secondary data. They are the most important currency indicators. It also answers a common question: can exchange rates forecast commodity prices?

They capture macroeconomic fundamentals at a higher rate compared to physical supply reports. It may take some time before such reports come up. The currency signal frequently arrives at your database.

Helpful Resource: Why Every Business Needs Live Commodity Data Now

The Commodity Currency Connection

A commodity currency is associated with a nation that has a high dependency on exports of natural resources. Australia (iron ore, gold) or Canada (oil). These exchange rates tend to follow the export values in such five countries as Australia, Canada, New Zealand, Chile, and South Africa. This is why people ask, can exchange rates forecast commodity prices?

This connection is important since FX markets tend to respond earlier than commodity spot markets. When export demand increases, the local currency will strengthen in a short time. That can serve as a timely indicator of price changes in commodities.

Categories Of Price Signals

Signal Type | Description | Key Metric |

Direct Correlation | Inverse relationship between USD and metals/energy. | USD vs commodity prices |

Trade-Weighted | Widespread currency baskets on a global level. | Trade-weighted exchange rates |

Leading Indicators | Money is circulating ahead of the physical good. | Cross-currency price signals |

Theoretical Insights: Research And Reality

Are exchange rates predicting commodity prices better than a random walk? This has been examined by scholars such as Kenneth Rogoff, Yu Chin Chen, and Barbara Rossi in the Quarterly Journal of Economics. According to their economic study, the value of commodity currencies is highly future-oriented.

Since exchange rates reflect future trade expectations. They can be used to predict the prices of global commodities at a strong theoretical resolution. This means can exchange rates forecast commodity prices in a way that is measurable and repeatable. This is not in-sample noise. It also passes out-of-sample testing.

It is a fact of consensus whether you are at the Massachusetts Institute of Technology or at Harvard College. Currencies usually show the way forward. They are able to indicate the changes before the prices of commodities respond fully. This is why many analysts ask, can exchange rates forecast commodity prices?

Technical Implementation: API-Based Forecasting

You do not require a PhD in international economics to be a developer. You need reliable data. Does the commodity price depend on exchange rates with no high-frequency feed?

Not easily. It is where the API-based forecasting is necessary. CommodityPriceAPI will be used to retrieve the current rates and the past rates. So you can test if can exchange rates forecast commodity prices.

This enables us to construct econometric forecasting models that explain commodity price fluctuations.

Step 1: Setting Up Your Environment

You will require Python and the requests library. You might ask, can exchange rates forecast commodity prices? Because we would like to make a comparison between future commodity prices and exchange rate fluctuations.

import requests

import pandas as pd

# Define your API Key from CommodityPriceAPI

API_KEY = "YOUR_API_KEY"

BASE_URL = "https://api.commoditypriceapi.com/v2"

def get_latest_commodity_data(symbols):

"""

Fetches real-time commodity prices.

"""

endpoint = f"{BASE_URL}/rates/latest"

params = {

"apiKey": API_KEY,

"symbols": ",".join(symbols)

}

response = requests.get(endpoint, params=params)

return response.json()

# Example: Fetching Gold (XAU) and Brent Oil

symbols = ["XAU", "BRENTOIL-FUT"]

data = get_latest_commodity_data(symbols)

print(data['rates'])Here is the output

{

'XAU': 2036.18,

'BRENTOIL-FUT': 82.47

}Step 2: Analyzing The Reverse Relationship

As we question can exchange rates forecast commodity prices, we need to examine the opposite. In other cases, the currency is actually driven by the movements of commodity prices. This is the opposite correlation between commodity price, which takes place frequently in Australia or Canada.

The /fluctuation endpoint could be used to monitor this. It assists in determining short-term imbalances in demand. It also indicates whether the movement is a part of a broader currency move. It shows how can exchange rates forecast commodity prices.

Helpful Resource: Integrate Commodity Prices API into Your App in Minutes

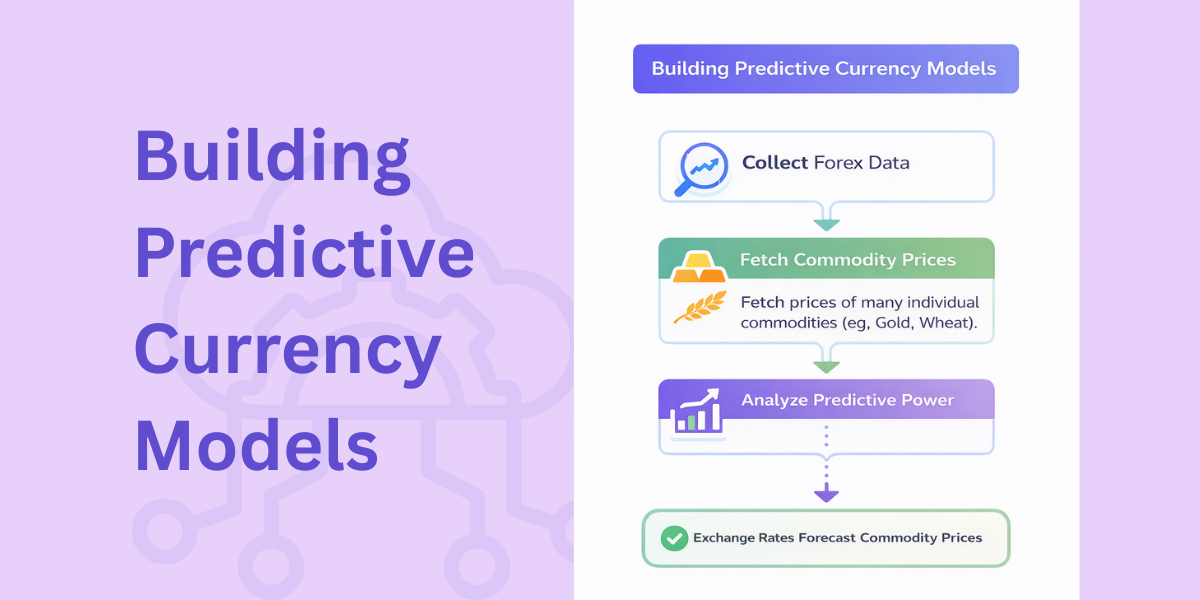

Building Predictive Currency Models

You require a time series method to establish whether the exchange rates predict the commodity trends. You also need to test if can exchange rates forecast commodity prices in a measurable way. Against broad aggregate commodity indices, you ought to compare quarterly data.

You can also compare daily feeds. Then, examine whether exchange-rate movements cause the index to move earlier. Check if the index is ahead by a couple of steps.

- Step A: Draw the forex data for commodity forecasting.

- Step B: Fetch prices of many individual commodities (e.g., Gold, Wheat).

- Step C: Conduct a regression analysis to determine whether the rates predict the movement of commodities with a 24-hour lag.

The answer is yes, commodity prices can be forecasted using the exchange rate in the short run. This proves to be the most useful when you are following cross-currency price signals. When the European Central Bank adjusts rates, the euro fluctuates and influences the prices of commodities.

This is why many analysts ask: Can exchange rates forecast commodity prices? Predicting exchange rates happens almost immediately.

Why Use CommodityPriceAPI For This?

When you are a policy maker or you work at a bank as a developer, there is no such thing as inaccuracy. CommodityPriceAPI offers:

- High Frequency: plus and premium users are updated in 60 seconds.

- Historical Depth: Information has been available since 1990 to test in the sample.

- Broad Coverage: 130+ commodities and broad aggregate indices.

You cannot use alternative benchmarks when forecasting commodity trends. You also need to know can exchange rates forecast commodity prices? When you model demand shocks and import costs. You require the deep forward markets data in real-time. You need it in JSON.

It is also used in testing assumptions during varying market cycles. You are able to place commodities side by side without having to deal with incomprehensible symbol mapping. Your dashboards remain dependable since they are all running on the same API logic.

This also helps when asking, can exchange rates forecast commodity prices across global markets? It supports both real-time and historical analysis.

Helpful Resource: Top Benefits of Using a Commodity Data API for Real-Time Pricing

TL;DR

- The Answer: Yes, commodity currency pairs are strongly forward-looking.

- The Logic: Exchange rates indicate the macroeconomic fundamentals prior to the reactions of physical markets.

- The Tool: Predict currency models using API-based forecasting, CommodityPriceAPI.

- The Evidence: University-level economic research (Rossi, Rogoff) proves strong predictive power in forecasting trends.

Conclusion

The question is Can exchange rates predict commodity prices? is no longer a debate. It's a strategy. Using forex data for commodity forecasting, you get an idea of what to expect in terms of commodity prices forecasting.

The association is high whether you are following individual commodities or commodity indices in particular. It appears quickly in changing market cycles. It is also made more evident with volatility spikes. You may wonder, can exchange rates forecast commodity prices?

With CommodityPriceAPI, you automate the process of finding cross-currency price signals. You cease to respond to the price changes of commodities. You start anticipating them.

Such a predictive feature is the difference between an amateur app and a professional finance tool. It improves decision timing.

It adds surprisingly robust power and increases the credibility of your tool as well. It also answers a common question: can exchange rates forecast commodity prices?

FAQs

How Does the USD Impact Global Commodity Prices?

Because the majority of commodities are traded in Dollars, USD vs commodity prices tend to be inversely related. Increasing the USD tends to make other countries find commodities more expensive, reducing demand.

Which Currencies Are Considered Leading Indicators?

AUD, CAD, and NZD are leading currency indicators since they are sensitive to trade volumes in raw materials.

Is the Relationship Always Consistent?

No, the currency-commodity correlation cannot be disrupted by short-term demand imbalances. It also cannot be disrupted by geopolitical events. Yet, the robust power of this connection shows up over longer quarterly data ranges.

Can I Use This for High-Frequency Trading?

Yes, you can get exchange rate changes with 60-second updates. These changes can signal that rates may predict commodity price movements using an API based prediction system.