Best Markets For Predicting Commodity Prices Using Futures, Spot & FX Data

Ejaz Ahmed

2 Feb 2026 • 8 min read

Suppose that you are a procurement manager of a large global manufacturing company. Unexpectedly, the cost of copper surges 15% in forty-eight hours. Your supply chain is falling apart, and your budget is destroyed.

This is because commodity prices do not move in a vacuum very often. In order to be ahead, you should examine the best markets for predicting commodity prices before the rush reaches your desk.

This guide examines the interaction between global commodity markets. We shall delve into the dynamics of the price fluctuations in various industries. You will know how to utilize global market data and market analysis to develop stronger forecasts, including the best markets for predicting commodity prices.

We will discuss all the futures market commodity prices and the FX market's influence on commodities. At the conclusion, you will be able to know how to apply the commodity insights to manage risks and make informed decisions.

Helpful Resource: Detecting Commodity Price Fluctuations For Smarter Trading Decisions

Why Market Correlation Matters For Price Discovery

The process by which buyers and sellers influence the price is called commodity price discovery. It does not occur in a single location. It occurs in a number of interrelated world commodity markets, which is why the best markets for predicting commodity prices are rarely just one market.

By following a single market, you lose the early commodity market indicators. Markets related to each other tend to experience price movements first. Such economic indicators tells what is to follow, and they often show up first in the best markets for predicting commodity prices.

Cross-market price correlation is used by traders to identify market trends. As an example, the fall of the US Dollar usually leads to an increase in crude oil. The majority of commodities are traded in USD.

A weaker dollar causes oil to be cheaper to the consumer who is using other currencies. That can lift demand. When the demand is higher, it may push the prices.

That is the reason why analysts follow FX, rates, and shipping costs as well. These signals add context, especially when you are mapping the best markets for predicting commodity prices. They ensure that forecasts are more accurate.

Key Leading Indicators Table

Market Type | Data Provided | Predictive Value |

Futures | Future delivery contracts. | Reflects market sentiment and expected supply |

Spot | Immediate delivery prices | Indicates existing physical supply chain tightness. |

FX (Forex) | Currency exchange rates | Indicates macroeconomic factors and purchasing power |

Derivatives | Options and swaps | Signals market volatility and risk mitigation needs |

The Role Of The Futures Market In Commodity Predictions

Futures market commodity prices are probably the most essential instruments of any investment plan. They are also one of the best markets for predicting commodity prices. A future is a legal contract of purchasing or selling a specific commodity at a certain price. It happens at a particular time.

Why It Works

Futures act as a crystal ball. They reflect the joint best guess of hedge funds, businesses, and users on the direction of prices, making them one of the best markets for predicting commodity prices.

The futures market responds immediately due to geopolitical factors. This occurs way before the physical oil or natural gas reaches the industry plants.

How To Use It

Focus on the "Forward Curve." When the future price is above the present price, the market anticipates a rise or supply run-offs. This is called Contango. When they are less, then it is Backwardation. These historical trends assist in the buyer's decision on when to stock.

Here is a simple code example:

const axios = require("axios");

const API_KEY = "YOUR_API_KEY";

const BASE_URL = "https://api.commoditypriceapi.com/v2/rates/latest";

async function fetchFuturesAndSpot() {

const response = await axios.get(BASE_URL, {

params: {

apiKey: API_KEY,

symbols: "XAU,WTIOIL,WTIOIL-FUT,COPPER"

}

});

const data = response.data.rates;

console.log("Commodity Market Snapshot");

console.log("-------------------------");

console.log(`Gold Spot (XAU): $${data.XAU}`);

console.log(`WTI Oil Spot: $${data.WTIOIL}`);

console.log(`WTI Oil Futures: $${data["WTIOIL-FUT"]}`);

console.log(`Copper Spot: $${data.COPPER}`);

}

fetchFuturesAndSpot();

Here is the output:

Commodity Market Snapshot

-------------------------

Gold Spot (XAU): $2034.12

WTI Oil Spot: $78.45

WTI Oil Futures: $81.90

Copper Spot: $3.98

Spot Market Price Signals: The Reality Of Supply And Demand

The spot market price signals inform you of what is going on at the moment. While future trends inform you of what might happen, which is why they matter in the best markets for predicting commodity prices.

The spot price refers to the on-the-spot price of direct delivery. It responds quickly to weather conditions, strikes, or port delays.

- Physical Reality: When spot prices increase at a faster rate than futures, there is an instant unavailability of supply.

- Logistics: High spot prices are usually indicative of disruptions in the supply chain.

- Arbitrage: The traders observe the difference between the spot and futures to make the trade decision.

In agricultural commodities, the spot prices are very seasonal. You are able to observe the changes in prices according to the harvesting periods. This information is used by analysts to give projections on the following fiscal period.

There are also teams that monitor inventory reports and shipping rates. These additional signals are the causes of sudden spikes.

They often point to the best markets for predicting commodity prices. They assist you in isolating real demand versus short-run noise.

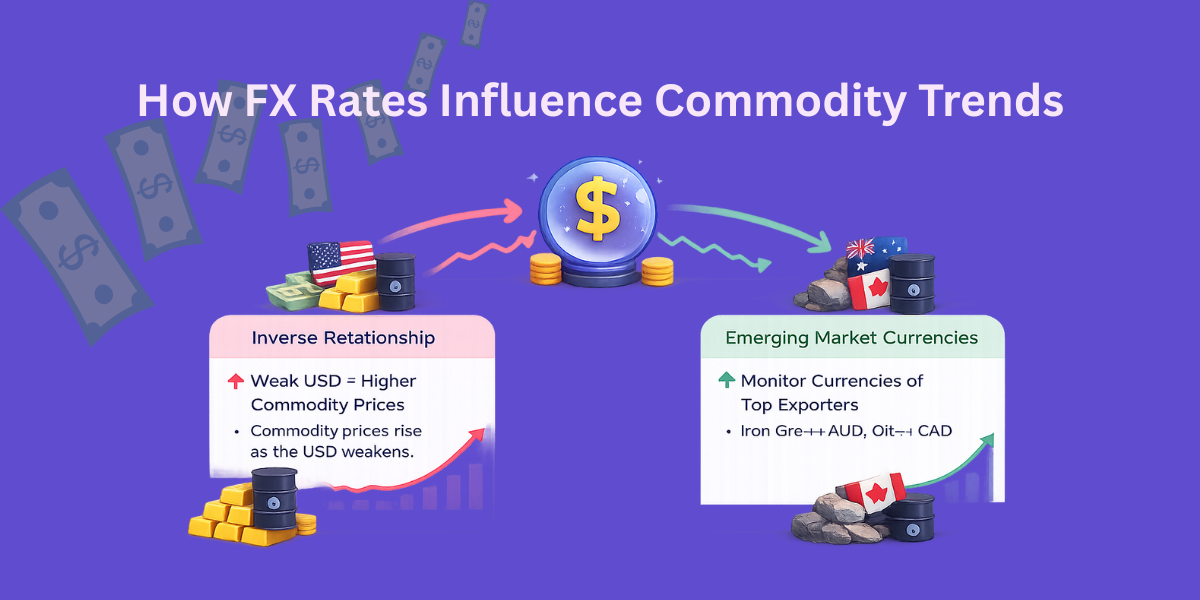

FX Market Impact On Commodities

The effect of the FX market on commodities is a strong macroeconomic lever. The majority of the commodities such as precious metals, as well as energy, are traded in Dollars. It implies that prices can be affected by a shift in currency even when the supply and demand appear to be stable.

The Inverse Relationship

Under the general situation, the USD and commodity prices are related in an inverse way. Fewer dollars are needed to purchase a barrel of oil as the dollar becomes rich and strong.

This may cause a decline in nominal prices despite constant demand. It can also squeeze the buyers with weaker local currencies.

Emerging Markets

Monitor the currencies of top exporters. As an illustration, the price of iron ore usually follows the Australian Dollar (AUD). Crude oil has a correlation with the Canadian Dollar (CAD).

Following such pairs will provide insight into your market analysis and the best markets for predicting commodity prices. Plot DXY, significant FX rates, and hedging costs together with your commodity charts.

Leveraging Market Data APIs For Real-Time Insights

You can not afford to live by yesterdays news to control risks. You have to get real-time market information across the world. This is where the market data APIs are necessary for contemporary development.

Companies can collect data automatically with the help of a provider, such as CommodityPriceAPI. You are able to get the most current prices of various industries such as metals, energy, and agricultural products.

This also helps you compare signals across the best markets for predicting commodity prices. Pulling historical prices is also available. You can test and backtest your forecasting models.

Live information will help you to respond more quickly to market changes. Easy to pipe JSON responses to dashboards, warehouses, or Python scripts. Using a clean feed, your team also saves time cleaning the data and spends time making decisions.

Practical Code Example: Fetching Real-Time Data (Node.js)

Here is how you can use the CommodityPriceAPI to get leading indicators for commodity prices.

const axios = require('axios');

// Replace with your actual API Key from CommodityPriceAPI

const API_KEY = 'YOUR_API_KEY';

const BASE_URL = 'https://api.commoditypriceapi.com/v2/rates/latest';

async function getCommodityTrends() {

try {

const params = {

apiKey: API_KEY,

symbols: 'XAU,WTIOIL-FUT,NG-FUT,XAG' // Gold, WTI Oil, Nat Gas, Silver

};

const response = await axios.get(BASE_URL, { params });

if (response.data.success) {

const rates = response.data.rates;

console.log('Real-time Market Insights:');

console.log(`Gold (XAU): $${rates.XAU}`);

console.log(`WTI Oil Futures: $${rates['WTIOIL-FUT']}`);

console.log(`Natural Gas: $${rates['NG-FUT']}`);

}

} catch (error) {

console.error('Error fetching market data:', error.message);

}

}

getCommodityTrends();Helpful Resource: Integrate Commodity Prices API into Your App in Minutes

Identifying Leading Indicators Across Sectors

Various industries react to different price forecasting signals. You need to classify your centre of interest across multiple sectors and the best markets for predicting commodity prices. You also need to track global commodity exchanges to make precise forecasts.

Energy And Electricity

Energy transition is changing our perception of consumption. Although crude oil is still king, natural gas and electricity markets are becoming volatile with geopolitical tensions. To track the market sentiment, analysts follow storage reports provided by the World Bank and EIA.

Metals And Industry

Precious metals such as gold are safe havens. Investors rush into them when the market is volatile.

Base metals such as copper are indicators of the global economic well-being and the best markets for predicting commodity prices. When the price of copper is high, it normally indicates industrial growth.

Agriculture

The agricultural products are subject to weather and supply logistics. Periodical traders provide predictions based on historical patterns to determine future prices. This also helps identify the best markets for predicting commodity prices.

The demand changes are also important, particularly during harvest and shipping periods. Monitoring these indicators makes the price prediction remain realistic.

Helpful Resource: How To Forecast Commodity Prices And Automate Market Alerts Using CommodityPriceAPI

TL;DR

- Futures give the future outlook and sentiments of the market.

- Spot markets indicate the real-time supply and demand.

- The effect of FX information (in particular USD) on commodities is enormous.

- Businesses can get actionable insights best through API integration.

- In order to mitigate risks, cross-market price correlation has to be considered.

Conclusion

Commodity prices are not a matter of fortune. It is the knowledge of the most suitable markets when predicting the prices of commodities and the interaction between them. Once you overlay derivatives market data with spot market price signals, you have a more 360-degree view of what is going on and why prices change.

The tools are important, be it in energy or precious metal tracking. Take advantage of the data provided in the world markets to be ahead of their geopolitical and other macroeconomic changes. Good data provider and good modeling is the way to move faster and make better decisions.

This is the way you convert volatility into an opportunity. You would see changes in the trend sooner, including signals from derivatives trading and the best markets for predicting commodity prices. You make fewer guesses, buys, hedges, and budgets.

FAQs

Which market is the most accurate for long-term predictions?

The futures market is generally thought to be the best for long-term trends and one of the best markets for predicting commodity prices. It represents the maximum expectations of institutional investors.

How does the World Bank influence commodity insights?

The World Bank offers a lot in its historical patterns and macroeconomic reports. These act as benchmarks for the analysts when making long term projections.

Can I get historical data for risk analysis?

Yes. CommodityPriceAPI provides a historical endpoint dating back to the year 1990. This is vital in backtesting and risk mitigation measures. Especially when you are studying the best markets for predicting commodity prices.