How To Forecast Commodity Prices And Automate Market Alerts Using CommodityPriceAPI

Ejaz Ahmed

5 Dec 2025 • 7 min read

Introduction

Commodity markets keep changing with time. Butter, oil, or gold prices can rise quickly overnight. Companies often struggle with purchasing, trading, and budgeting issues. Mistakes made in predicting price patterns could result in losses or missed chances. This is why it is important to predict the prices of commodities. But How to Forecast Commodity Prices?

Through prediction, you will make informed choices and reduce financial risk for commodity futures. New tools, such as the CommodityPrice API, are used to provide real-time and historical data for commodity currencies. They allow for accurate prediction and automatic alerts.

Here, in this article, you will learn:

- Understanding Commodity Price Forecasting

- How to Forecast Commodity Prices for Supply and Demand Dynamics

- Common Commodity Price Forecasting Methods

- Commodity Price Forecasting Models Explained

- Why Real-Time Data Matters In Forecasting

- Step-By-Step: Automating Commodity Market Alerts With Flask

- Example Use Case: Forecasting The Butter Commodity

- Integrating Forecasts Into Business Decisions

So let’s get started.

Understanding Commodity Price Forecasting

Commodity price forecasting involves commodity price prediction based on historical data, market trends, and external factors. Traders, businesses, and analysts use the forecasts to make informed decisions quickly for the stock and bond markets.

For example, a butter producer can adjust production according to the trend in dairy prices. Past trends can be used by gold investors to inform their buying decisions. Crude oil traders can manage their trades by anticipating changes in supply and demand for economic growth. It is important to note that prices fluctuate significantly in terms of stock prices, futures markets, and industrial production.

Businesses often fail to respond promptly without accurate prediction even with deep learning models. They risk paying more, or they lose out. This is why they go for commodity prices APIs instead of machine learning models for macroeconomic indicators and bloomberg precious metals subindex.

How to Forecast Commodity Prices?

To estimate the prices of commodities, first, collect past and current data. Consider it in terms of seasonal changes, the balance of supply and demand, and market trends. Then use prediction methods such as SMA, ARIMA, or machine learning. Combine basic, technical, and econometric methods to obtain a more accurate estimate of energy prices in developing countries.

You can also use artificial neural networks but using APIs comes with better results for energy economics, financial variables. This helps in better decision-making before natural disasters occur.

Set up automatic price messages and utilize APIs, such as CommodityPriceAPI, to obtain current price information. This also helps you make fast decisions based on facts before market shifts affect your profits.

Common Commodity Price Forecasting Methods

There are various prediction methods, depending on their level of difficulty and intended purpose. The main ways include:

How to Forecast Commodity Prices through Fundamental Analysis

In this method, the analysis of supply and demand, production costs, seasonal fluctuations, and political conditions is conducted. It helps with goods such as oil or farm products.

Technical Analysis

Technical analysis involves the use of past price charts and trend patterns to make predictions about future prices. It is common among traders in financial markets.

Econometric Models

Econometric models are statistical models that measure the impact of factors on prices. To show this, the prices of wheat may be influenced by weather conditions or export regulations.

This is because a mix of ways tends to make the guess better. It gives a balanced view of the market trends.

Commodity Price Forecasting Models Explained

Models transform raw data into actionable insights. Here are the main models:

Model | Description | Best Use Case |

Simple Moving Average (SMA) | Averages past prices over a fixed period | Short-term trend smoothing |

ARIMA | Captures trends, seasonality, and noise in time-series data | Mid-to-long-term forecasting |

Machine Learning (Random Forest, XGBoost, LSTM) | Detects complex patterns in large datasets | High-frequency or multi-factor forecasting |

SMA is easy and quick for short-term trends. ARIMA works well when dealing with steady past data. Machine learning works with complicated data and several factors that control the price. Choose the model based on the size of the data, the extent to which the price fluctuates, and how far ahead you want to predict.

Why Real-Time Data Matters In Forecasting Energy Commodities

Old information may lead to wrong ideas in market sentiment. Real-time commodity assets data will ensure that the market changes are responded to quickly. APIs make this possible.

The CommodityPrice API gives fast and exact information on 130 commodities and other commodity indices. It provides historical information dating back to 1990.

You can access endpoints to get the newest prices, time series, and daily changes. Live information makes the prediction more accurate. It enables you to respond quickly to new market changes.

How to Forecast Commodity Prices Step-By-Step: Automating Commodity Market Alerts with Flask

To automate the commodity market alerts, you need to have a data source that gives you reliable data. For example, most of the developers use APIs these days. Commodity Price API is one such reliable data source.

The API provides access to 130+ commodities, including gold (XAU), silver (XAG), oil, and more. You get the JSON responses that you can parse using different techniques within your applications or websites. Here is the sample JSON response for commodity exchange rates api:

{

"success": true,

"timestamp": 1703866777,

"rates": {

"WTIOIL": 72.29,

"XAU": 2066.98

},

"metaData": {

"XAU": {

"unit": "T.oz",

"quote": "USD"

},

"WTIOIL": {

"unit": "Bbl",

"quote": "USD"

}

}

}Choose a reliable programming language or tech stack that the API should support. For forecasting the commodity prices, you can use the timeseries endpoint.

Developers can schedule automated checks for price fluctuations or thresholds and trigger instant notifications via email, SMS, or dashboards.

Step 1: Virtual Environment

Create a virtual environment in python:

python -m venv commodity_envActivate the environment:

commodity_env\Scripts\activateStep 2: Install Libraries

Install the required libraries:

pip install flask requests pandas matplotlib scheduleStep 3: Fetch Prices from API

Fetch commodity prices from API using this code:

import requests

API_KEY = "YOUR_API_KEY"

BASE_URL = "https://api.commoditypriceapi.com/v2/rates/latest"

def get_commodity_prices(symbols=["XAU","WTIOIL"]):

params = {

"symbols": ",".join(symbols),

"apiKey": API_KEY

}

# or alternatively, you could use headers

# headers = {"x-api-key": API_KEY}

response = requests.get(BASE_URL, params=params)

data = response.json()

if data.get("success"):

return data["rates"], data.get("metaData", {})

else:

print("Error:", data)

return None

if __name__ == "__main__":

prices, metadata = get_commodity_prices()

print(prices)

print(metadata)

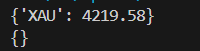

Output:

Step 4: Save Prices in CSV

Add this function in code to save prices in csv, so later they could be shown on Dashboard:

def save_prices(prices):

df = pd.DataFrame([prices], index=[datetime.now()])

try:

old_df = pd.read_csv(CSV_FILE, index_col=0, parse_dates=True)

df = pd.concat([old_df, df])

except FileNotFoundError:

pass

df.to_csv(CSV_FILE)Step 5: Set Threshold for Alerts

Set a threshold for prices and functions for alert:

SYMBOLS = ["XAU", "WTIOIL"]

THRESHOLDS = {"XAU": 4100, "WTIOIL": 75}

def check_alerts(prices):

alerts = []

for symbol, price in prices.items():

if symbol in THRESHOLDS and price >= THRESHOLDS[symbol]:

alerts.append(f"ALERT: {symbol} price crossed threshold: {price}")

for alert in alerts:

print(alert) # console log

return alerts

def fetch_and_alert():

global latest_alerts

prices, _ = get_commodity_prices()

if prices:

save_prices(prices)

latest_alerts = check_alerts(prices) Step 6: Simple dashboard

In the project folder, create a file template/index.html:

<!DOCTYPE html>

<html>

<head>

<title>Commodity Dashboard</title>

</head>

<body>

<h1>Latest Commodity Prices</h1>

<ul>

{% if prices %}

{% for symbol, price in prices.items() %}

<li>{{ symbol }}: {{ price }} USD</li>

{% endfor %}

{% else %}

<li>No price data yet.</li>

{% endif %}

</ul>

<h2>Alerts</h2>

<ul>

{% if alerts %}

{% for alert in alerts %}

<li style="color:red;">{{ alert }}</li>

{% endfor %}

{% else %}

<li>No alerts at this time.</li>

{% endif %}

</ul>

</body>

</html>

This is the complete code for dashboard:

from flask import Flask, render_template

import requests

import pandas as pd

from datetime import datetime

import schedule

import time

import threading

# ------------------ CONFIG ------------------

API_KEY = "e66377ea-6a15-4676-9cb0-f5bb386d8f7b"

BASE_URL = "https://api.commoditypriceapi.com/v2/rates/latest"

SYMBOLS = ["XAU", "WTIOIL"]

THRESHOLDS = {"XAU": 4100, "WTIOIL": 75} # Example thresholds

CSV_FILE = "commodity_prices.csv"

# Store the latest alerts to show on dashboard

latest_alerts = []

# ------------------ FUNCTIONS ------------------

def get_commodity_prices(symbols=SYMBOLS):

params = {

"symbols": ",".join(symbols),

"apiKey": API_KEY

}

response = requests.get(BASE_URL, params=params)

data = response.json()

if data.get("success"):

return data["rates"], data.get("metaData", {})

else:

print("Error fetching API:", data)

return None, None

def save_prices(prices):

df = pd.DataFrame([prices], index=[datetime.now()])

try:

old_df = pd.read_csv(CSV_FILE, index_col=0, parse_dates=True)

df = pd.concat([old_df, df])

except FileNotFoundError:

pass

df.to_csv(CSV_FILE)

def check_alerts(prices):

alerts = []

for symbol, price in prices.items():

if symbol in THRESHOLDS and price >= THRESHOLDS[symbol]:

alerts.append(f"ALERT: {symbol} price crossed threshold: {price}")

for alert in alerts:

print(alert) # console log

return alerts

def fetch_and_alert():

global latest_alerts

prices, _ = get_commodity_prices()

if prices:

save_prices(prices)

latest_alerts = check_alerts(prices)

# ------------------ SCHEDULE JOB ------------------

def run_scheduler():

schedule.every(1).hour.do(fetch_and_alert)

while True:

schedule.run_pending()

time.sleep(60)

# ------------------ FLASK DASHBOARD ------------------

app = Flask(__name__)

@app.route("/")

def dashboard():

try:

df = pd.read_csv(CSV_FILE, index_col=0, parse_dates=True)

latest_prices = df.iloc[-1].to_dict()

except FileNotFoundError:

latest_prices = {}

return render_template("index.html", prices=latest_prices, alerts=latest_alerts)

# ------------------ RUN APP ------------------

if __name__ == "__main__":

# Fetch prices once before starting Flask

fetch_and_alert()

# Start scheduler in background

t = threading.Thread(target=run_scheduler, daemon=True)

t.start()

# Start Flask

app.run(debug=True)

Output:

How to Forecast Commodity Prices: Conclusion

Commodity price forecasting gives you a chance to manage market risks. It stops you from buying when prices are high. It makes you buy when prices are low. You can guess trends. Utilize past data, employ statistical modeling, and incorporate live updates. APIs like CommodityPriceAPI make this easy. They give live information for over 130 commodities.

Alerts and Limits are easy to automate. This helps your team to make quick, good decisions. Integrate forecasts with business plans. This makes procurement, trading, and budgeting better. Do not wait until the market changes. Do not let changes impact your profit. CommodityPriceAPI is available today.

FAQs

How To Predict Commodity Prices?

Look at past information. Use statistical tools. Watch the market trends. The best of all? Use a Commodity Price API.

How Can AI Help in Commodity Market Forecasting?

AI identifies complex patterns in large datasets. It spots patterns and unusual things. Humans might miss these.

What Are The Common Commodity Price Forecasting Methods?

They are econometric models, fundamental analysis, and technical analysis. For developers, using APIs is the most reliable method to get commodities data.

Can I Automate the Commodity Forecasting Market?

Yes, obtain the data; then, guess the direction and Issue alerts using APIs. Use APIs like CommodityPriceAPI.