How Interest Rates Affect Commodity Prices: A Data-Driven API Analysis

Ejaz Ahmed

11 Feb 2026 • 6 min read

Suppose that you are a hedge fund manager or supply chain lead. Suddenly, the Federal Reserve makes an announcement of a surprise increase of 50 basis points. On a few minutes' notice, gold prices decline, and your crude oil futures prices are red. Why did this happen?

It is important to know how interest rates affect commodity prices for anyone in the financial markets. This correlation is not merely theoretical, but a mechanical change in the market liquidity and cost. When the central banks adjust the needle, all asset classes feel the vibration.

In this guide, we shall discuss the monetary policy impact on commodities. We will examine USD strength and commodity prices, the cost of carry model, and real interest rates. We will also cover how interest rates affect commodity prices.

Lastly, we will demonstrate the process of drawing the historical interest rate data with the CommodityPriceAPI. You may use it to develop your personal commodity analysis tools based on data. We should explore the dynamics of higher commodity prices.

The Core Relationship: Why Interest Rates Matter

In its simplest form, interest rates indicate the price of money. Borrowing is costly when the interest rates rise. This mere fact causes a domino effect in the commodity markets.

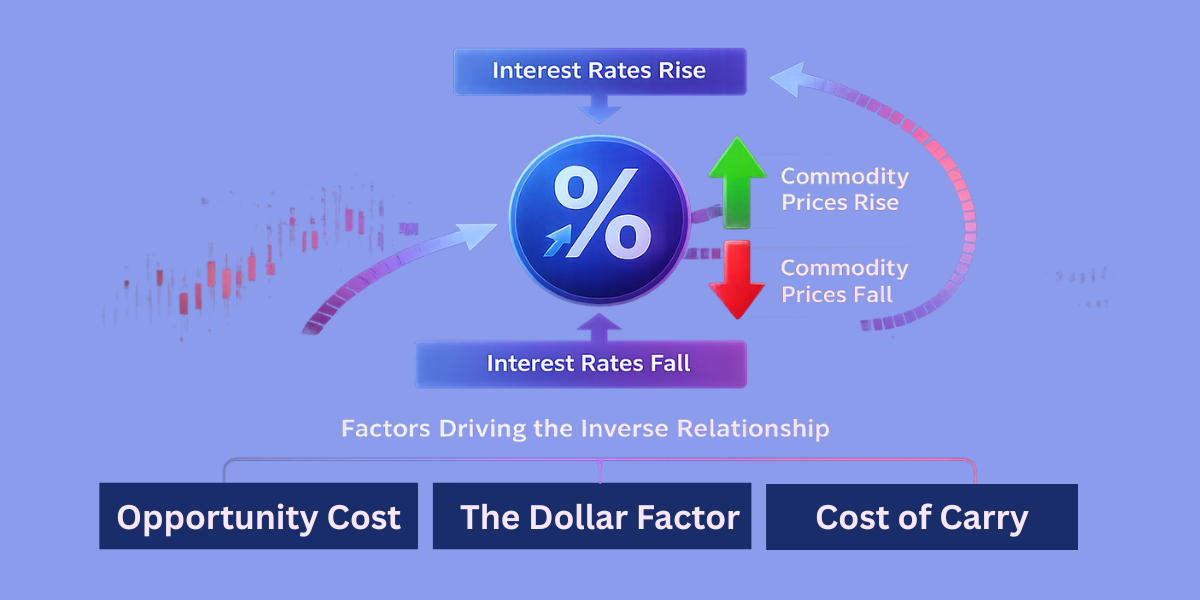

Interest rates fall in proportion to the price of commodities. Increasing the cost of borrowing by the Federal Reserve Bank tends to reduce the prices of commodities. On the other hand, as interest rates are decreasing, rising commodity prices are usually increasing.

Factors Driving the Inverse Relationship

- Opportunity Cost: Goods such as gold do not pay dividends. Investors run away with raw materials when treasury bills are paying high yields.

- The Dollar Factor: High rates cause the USD to become strong, and the price of commodities tends to drop as a consequence.

- Cost of Carry: High rates raise storage expenses and financing expenses on those commodities that are storable.

How Interest Rates Affect Commodity Prices: The Transmission Channels

You need to know how to master data-driven commodity analysis. You also need to understand how interest rates affect commodity prices. Monetary policy does not strike market prices. It goes via certain economic channels.

The Currency Channel (USD Strength)

The majority of world commodities are in U.S. Dollars. An increase in the rate by the Federal Reserve will draw more international capital into the dollar, showing how interest rates affect commodity prices.

The weak dollar will reduce the prices of commodities in the global market. The reverse of this is a stronger dollar that exerts downward pressure on crude oil and agricultural commodities.

The Cost of Carry Model

A cost of carry model is a theoretical model of the futures traders. It describes how interest rates affect commodity prices on the price of futures contracts.

When you actually have copper in your possession, you get storage costs and insurance. You also lose the real interest that would have been earned in a bank.

Demand and Economic Activity

Interest rates increase, which reduces economic growth. The economic activity declines when there is a low level of GDP growth. This causes a reduction in the demand for raw materials such as steel and energy, showing how interest rates affect commodity prices.

Impact Area | High Interest Rates | Low Interest Rates |

USD Strength | Stronger Dollar | Weaker Dollar |

Storage Costs | Higher (Expensive to hold) | Lower (Cheap to hold) |

Investment | Shift to Bonds | Shift to Riskier Assets |

Consumer Demand | Decreasing | Increasing Demand |

Analyzing Inflation And Commodity Prices

We could not discuss the effect of monetary policy on commodities without referring to inflation. In many instances, the central banks increase rates initially because of increasing commodity prices and how interest rates affect commodity prices.

The real interest rates (the real nominal rate minus inflation) are the real driver. When inflation and commodity prices are increasing at a high rate, but the interest rates remain low, the real interest rates will be negative. This is fuel for commodity price dynamics.

Commodities are a hedge for investors. As the money supply increases at an unsustainable rate, individuals invest in gold or oil-associated financial instruments to safeguard their current value. This is a loop of growing volatility and price volatility that has to be continuously monitored through a trustworthy API.

Helpful Resource: Detecting Commodity Price Fluctuations For Smarter Trading Decisions

Data-Driven Analysis: Fetching Real-Time Prices

You require data to find out how interest rates affect commodity prices in the real world. With the CommodityPriceAPI, the interest rate movements can be compared to real prices.

Practical Code Example: Python Integration

Following is a script to fetch crude oil and gold prices. This can be plotted against historical interest rates data.

Python

import requests

# Your API Key from CommodityPriceAPI

API_KEY = 'YOUR_API_KEY'

BASE_URL = 'https://api.commoditypriceapi.com/v2/rates/latest'

# Defining the symbols for analysis

# XAU = Gold, WTIOIL-FUT = WTI Crude Oil

params = {

'apiKey': API_KEY,

'symbols': 'XAU,WTIOIL-FUT,XAG'

}

response = requests.get(BASE_URL, params=params)

data = response.json()

if data['success']:

rates = data['rates']

print(f"Current Gold Price: {rates['XAU']} USD")

print(f"Current WTI Oil Price: {rates['WTIOIL-FUT']} USD")

else:

print("Error fetching commodity price movements.")Here is the output

Current Gold Price: 2034.52 USD

Current WTI Oil Price: 78.41 USDYou can observe the impact of interest rate increases in real-time by running this on a periodic basis when decisions are made by the central bank. You will observe the market reaction to changes in short-term interest rates.

Helpful Resource: Commodities API Free – The Best Way to Access Real-Time Commodity Data

Categories of Commodities Affected

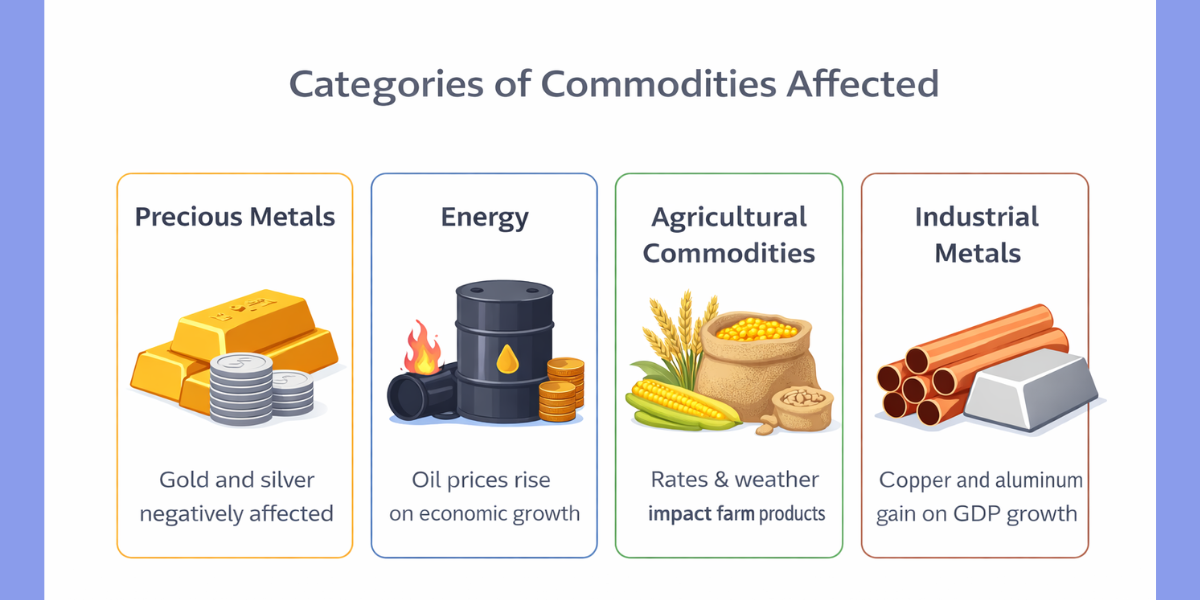

Commodities do not respond to interest rate increases in a similar manner. The macroeconomic indicators are more sensitive to some of them, showing how interest rates affect commodity prices.

- Precious Metals: This is very sensitive. The effect of the real interest rates on Gold and Silver is negative.

- Energy: Economic expansion and USD strength drive oil prices.

- Agricultural Commodities: The agricultural commodity prices depend on the cost of storage and interest rate risk, but weather is also a factor.

- Industrial Metals: Copper and Aluminum follow a stronger economic growth and gdp growth.

The Role of the Futures Market

You require data to find out how interest rates affect commodity prices in the real world. With the CommodityPriceAPI, the interest rate movements can be compared to real commodity prices.

The changes in interest rates cause changes in the value of future deliveries. Futures traders are required to estimate whether the profit potential is more than the cost of carrying inventories.

In case of the short-term interest rates are too high, they might make less frequent inventories. This may result in volatility of prices. This shows how interest rates affect commodity prices.

Helpful Resource: Best Markets For Predicting Commodity Prices Using Futures, Spot & FX Data

Empirical Validity and Exceptions

Although the theoretical model indicates that there is an inverse relationship, other factors may intervene. In some cases, there is a positive correlation between interest rates and commodity prices.

This is observed in times of high economic growth. In case the demand becomes so strong that it exceeds the impact of interest increases. This continues to increase the prices, showing how interest rates affect commodity prices.

These are also referred to as idiosyncratic shocks. The American Journal of Agricultural Economics is always the source of deep-dive studies on these outliers.

TL;DR

- Inverse Relationship: Generally, the effect of interest rates on commodity prices is in an inverse relationship.

- The Dollar: Increased rates will boost USD, creating low commodity prices.

- Inventory: With increased rates, the cost of storage also rises, making people reluctant to have inventories.

- Growth: The central bank policy impact slows GDP growth, which lowers demand for raw materials.

- Real Rates: Nominal rates are less important than real interest rates as commodity prices fluctuate.

Conclusion

Learning the impact of interest rate hikes and commodities is a breakthrough for your portfolio. It will enable you to make wiser choices on how interest rates affect commodity prices.

Price volatility can be forecasted by following monetary policy and central bank decisions. You could tell its presence in the financial markets before it occurs.

It can be crude oil, agricultural commodities, or precious metals. With the price of money determining the flow of trade, you can see how interest rates affect commodity prices. It influences the movement of capital.

The CommodityPriceAPI is a data-driven commodity analysis approach that makes sure you do not guess. You are responding to the live prices in the market.

FAQs

Do Rising Interest Rates Always Crash Oil Prices?

Not always. When the economic activity is booming, the declining pressure of rising interest rates can be neutralized by growth in demand.

How Does The Money Supply Affect Storable Commodities?

The supply of money has a tendency to increase and cause inflation. This has the potential of driving up the cost of commodities, and central banks can respond by increasing rates.

What Is The Impact Of A Weaker Dollar?

A fall in the dollar tends to make commodities affordable to international consumers. It may result in an increase in the prices of commodities.