Gold Prices Data: Top 10 Reliable Sources You Must Try

Ejaz Ahmed

17 Feb 2026 • 8 min read

Consider that you are developing a fintech application or a jewellery inventory system. Suddenly, the market shifts. When your data is delayed or inaccurate on gold prices, your users will lose value and confidence.

Accuracy is all in the unstable world of precious metals. It is never enough to be close. To remain competitive, you must be precise, fast, and reliable.

This guide discusses the most effective means of obtaining gold prices data. We deal in high-performance APIs, financial databases, and historical archives. You will find the best gold price historical data sources.

If you want to see the live prices in US dollars, Euros, or British pounds, this guide would help. You will also know how to blend them into each other. We will identify the right data partner to work with.

1. Using APIs For Real-Time And Historical Data

APIs are the new standard for developers. They enable you to import gold prices data into your system. This automatically keeps your application up to date.

They prevent the necessity of manual downloads or imports into a spreadsheet. Your system is able to demand new prices within seconds. Automation minimises errors made by humans and enhances reliability.

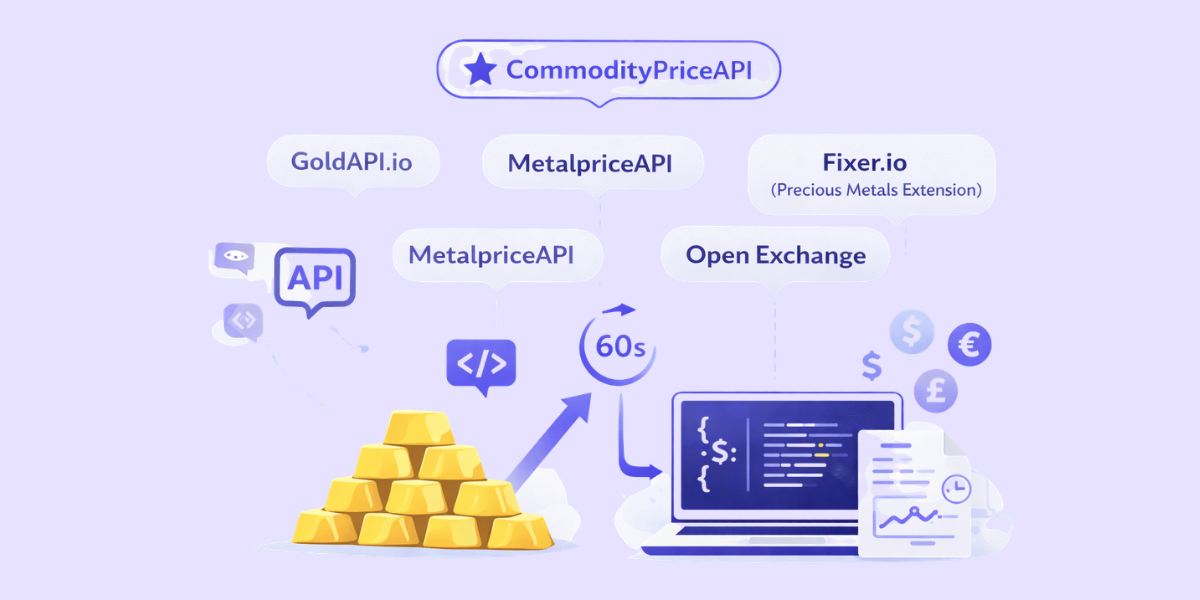

CommodityPriceAPI: The Developer's Top Choice

CommodityPriceAPI is the best solution in case you need speed and simplicity. It provides high frequency of JSON data with an update frequency of 60 seconds. It is perfect in trading platforms where time counts.

It has more than 130 assets such as gold, silver, and crude oil. We have the gold spot price historical data as far back as 1990. It also translates the gold prices data to 175+ currencies.

Key benefits include:

- 60-second real-time updates

- Historical gold data since 1990

- 130+ supported commodities

- 175+ quote currencies

- Easy REST JSON integration

This flexibility makes it suitable for international platforms. Investors are allowed to quote in Chinese Yuan or Swiss francs using gold price data historical insights. Implementation is smooth for developers.

GoldAPI.io

GoldAPI.io specializes in precious metals. It focuses on troy ounces and grams. This is applicable to basic web widgets.

It is not heavy and is simple to use. But it is not in favor of general commodities. It can be restrictive for professional traders.

It is compatible with small applications and dashboards. It can be set up easily and integrated with minimal time by developers. It is most appropriate on metal-based platforms.

MetalpriceAPI

MetalpriceAPI combines the gold prices data with currency exchange rates. It is also dependable to the prevailing market rates. A great number of users track the dollar fluctuations against the bullion value.

It supports various currencies. The level of historical depth is moderate. It is convenient for simple tracking requirements.

The API is uncomplicated and predictable. It is suitable as a lightweight financial tool. It is commonly used by small companies to update their prices.

Fixer.io (Precious Metals Extension)

Fixer.io is popular regarding forex data. It also provides the gold prices data as an extension. This facilitates it among currency-centered platforms.

When gold is secondary to your forex application, it works fine. It is easily integrated. It is not even metal-centered.

It suits platforms that already rely on Fixer to get exchange rates. The addition of gold involves a few configuration modifications. This saves much time in terms of development.

Comparison Of Top Gold Data APIs

Feature | CommodityPriceAPI | GoldAPI.io | MetalpriceAPI |

Update Frequency | 60 Seconds | 1–5 Minutes | 10+ Minutes |

Historical Data | From 1990 | Limited | Moderate |

Supported Assets | 130+ (Gold, Oil, etc.) | Metals Only | Metals & FX |

Quote Currencies | 175+ | 100+ | 150+ |

Ease of Integration | High (REST JSON) | Medium | Medium |

Helpful Resource: How to Use a Free Commodities Price API in Web & Mobile Apps

2. World Gold Council (Data Gold Price Central)

The World Gold Council is a safe source of information about gold markets. It offers the gold prices historical annual data over decades. Scientists depend on its long datasets.

The gold price monthly historical data are available for free. This assists in the analysis of behavior in times of recession and inflation. It also releases information on demand and supply.

The information is academically viable. It is extensively used in the literature. Its archives, including gold data price records, are very useful to long-term investors.

3. Yahoo Finance (Daily Gold Price Data)

Yahoo Finance is still popular among investors. It provides CSV files of gold prices data per day that can be downloaded, making it useful for gold price data download needs. Trends are easy to analyze gold price data excel.

The tab of gold prices historical data is easy to use. You may choose weekly, monthly, and custom ranges. It is easy to export the historical gold prices data.

Its API is not free anymore officially. However, manual downloads will still be helpful, especially when reviewing gold price history data. It can be used to analyze quickly.

4. Nasdaq Data Link (Formerly Quandl)

Nasdaq Data Link offers institutional-grade historical sets of gold prices data. It emphasizes clean and structured data sets. It can be frequently used by machine learning teams.

It provides a safe and trusted access. The datasets are properly documented. It is constructed in professional settings.

It can also be integrated with Python and R environments. Its access is API-driven, which financial analysts like. Its structured delivery is relied upon by large-scale quantitative models.

5. Investing.com

Investing.com provides real-time gold price charts. It shows gold spot price historical data with indicators. It is applied to technical analysis by traders.

It captures market sentiments. It monitors expectations around gold data price. Traders have a strong belief in it.

Economic calendars and news alerts are also available on the platform. These characteristics assist traders in predicting volatility. It is applicable in the short-term monitoring of the market.

6. A-Mark Precious Metals

A-Mark Precious Metals deals in the physical bullion market. It offers both buying and selling gold prices data. This serves the purpose of retail investors.

Its cost is based on cash market reality. It not only covers paper-based trading data. The greatest beneficiary is physical buyers.

The price is frequently used by dealers to make inventory decisions. It facilitates the wholesale and retail bullion operations. It is focused on the transactions of tangible assets.

7. LBMA (London Bullion Market Association)

The LBMA is the international standard of gold. It uses the LBMA Gold Price as its industry standard. This is where many platforms obtain data.

It offers reference-grade prices. Pricing is standardized in kilograms and ounces. It is important to institutions.

It is a formal auction process to determine the price. Big banks are involved in the setting mechanism. This is a way of ensuring transparency and credibility.

8. Federal Reserve Economic Data (FRED)

FRED offers historical prices of gold on a long-term basis. It is run by the St. Louis Fed. The service is free of charge.

It permits macroeconomic comparisons. You are able to learn about inflation, gold correlation, and past performance. Economic modeling can be used in it.

Researchers tend to use gold prices data along with CPI and GDP values. The platform allows downloadable charts and datasets. It can be utilized in academic analysis.

9. Kitco

Kitco is recognized by Live Gold Kilo charts. It offers news and the daily gold price historical data. Beginners often start here.

It is a mixture of pricing, gold prices data, and commentary, which is especially helpful when buying gold. Market updates are frequent. It is easy to navigate.

Kitco also has mobile access and alert systems. Customers are able to track price changes in real time. It suits common investors.

10. DataHub.io

DataHub is a service offering curated datasets, such as a well-known gold prices data set that is a compilation of historical data from different world banks. It is an excellent source of gold price daily data csv to perform offline data science projects.

The data is transparent and simple to access. They are used by many developers to backtest strategies using gold prices data. It is particularly applicable in academic/prototype models.

Technical Integration: How To Get Gold Prices Data Programmatically

With CommodityPriceAPI, you can get the gold prices data immediately for smarter investment decisions. The process of integration is not challenging, even if it is your first time working with an API. A real-world example of Python is displayed below.

import requests

api_key = 'YOUR_API_KEY'

base_url = 'https://api.commoditypriceapi.com/v2/rates/latest'

params = {

'apiKey': api_key,

'symbols': 'XAU',

'quote': 'USD'

}

response = requests.get(base_url, params=params)

data = response.json()

if data['success']:

price_per_ounce = data['rates']['XAU']

print(f"The current gold price is ${price_per_ounce} per ounce.")

else:

print("Error fetching gold price data.")Here's the output

The current gold price is $2034.56 per ounce.Helpful Resource: Integrate Commodity Prices API into Your App in Minutes

Why Use JSON For Gold Data?

In modern applications, JSON is the recommended format used in delivering gold prices data. It is lightweight, thus it loads fast and reduces the server strain. This assists in decreasing delays in trading dashboards and financial tools.

It is also well readable and organized, which strengthens overall security. JSON can be easily searched in nearly all programming languages by the developer on any integration page. It has a key-value format that verifies data clearly and can be interpreted by both humans and machines.

Most importantly, JSON is flexible. It facilitates easy conversion of currencies between the USD, Euros and British pounds. This ensures its suitability for gold-based global fintech systems, dynamic gold pricing, and reliable gold prices data.

TL;DR

For Developers: CommodityPriceAPI supports real-time updates and is able to use JSON.

For Researchers: Gold prices historical annual data on the World Gold Council.

Quick Analysis: Excel downloads with Yahoo Finance.

For Benchmarking: LBMA to be used in the official gold fix.

Conclusion

Any financial system requires reliable gold prices data. The accuracy of your platform will be determined by the quality of your source. Minor discrepancies may have severe financial implications.

CommodityPriceAPI provides speed and depth to real time usage. The 60-second updates are preventing its pricing from staying competitive in volatile markets. Analysis is enhanced by historical data that dates back to 1990.

Trust is created by accurate data, including gold prices data, among users and investors. Trading, inflation analysis, and inventory management require reliable pricing. Select your source with care and use trusted sources.

You make smarter decisions when your data foundation is strong in the present day and when you compare it with the previous day. Better strategy and execution come as a result of confidence in pricing. In precious metals, there is no such thing as precision.

FAQs

Where Can I Find Historical Gold Prices Data For Free?

Free data is available at the World Gold Council or FRED. These are sources of reliable long-term data. Free trials are also a way through which the APIs can be tested by developers.

Is There A Way To Get Gold Price Daily Data Csv?

Yes, Yahoo Finance and Investing.com do support CSV download for gold prices data. You have to choose custom date ranges. Directly, the file can be opened in Excel.

What Is The Difference Between Gold Spot Price And Futures?

The gold spot price represents instant delivery. Futures are contracts with respect to a future date. The majority of APIs, including those providing gold prices data, are set to spot pricing.

How Often Does Gold Price Data Update?

Market-leading APIs are renewed every 60 seconds. There are certain free websites that update on a daily basis. Others may have a short delay.

Can I Get Gold Prices In Currencies Other Than USD?

Yes, APIs that are used professionally are multicurrency. You can quote gold in either the British pound or the Euro. The Swiss francs are also supported.

How Accurate Is Real-Time Gold Prices Data From APIs?

The level of accuracy relies on the provider and the sources of information. Trusted market feeds are used in premium APIs. Always verify update frequency and transparency.

Which Gold Prices Data Source Is Best For Fintech Applications?

Fintech applications require current updates and multiple currencies. Quick JSON delivery APIs will work. Select on the basis of speed and reliability.

Can I Use Gold Prices Data For Algorithmic Trading Models?

Yes, the history of gold prices data can be used to back-test and analyse. Raw data is also required to be clean and organized. Timestamps are a good idea to increase the accuracy of the models.

What Should I Check Before Choosing A Gold Prices Data Provider?

Turnover and historical depth. Uptime assurances and review records. One should always choose verified and trusted sources.