What Are Commodity Prices? A Simple Guide with Examples

Ejaz Ahmed

4 Dec 2025 • 8 min read

Commodity exchanges continually evolve over time, influenced by a range of factors. These factors can include global events, shifting market demand, and supply chain issues. As a result, financial decisions can be a challenge for investors, traders, and other regular customers.

To address this uncertainty, we must understand the factors that drive changes in commodity markets. Plus, we also need to know how to track these more effectively. In this blog, we will clear all these things for you. You will learn what are commodity prices API.

This blog addesses:

- What Are Commodity Prices?

- How Commodities Function in the Market

- Commodity Buyers and Producers: Roles and Strategies

- Key Factors Influencing Commodity Prices

- What Determines Commodity Prices?

- What Are Commodity Prices Types?

- Why Are Commodity Prices Important?

- Where to Check Live Commodity Prices?

Let's get started.

What Are Commodity Prices?

Primary goods or basic raw materials that you can trade, buy, or sell are known as commodities. One of the most important aspects of commodities is that they significantly influence a country's economic index. The reason? They help us produce the materials we use in daily life. These can be electronics, fuels, and construction materials.

Commodities are traded on organized exchanges like the Chicago Mercantile Exchange or the London Metal Exchange. As a result, we ensure standardized pricing and quality.

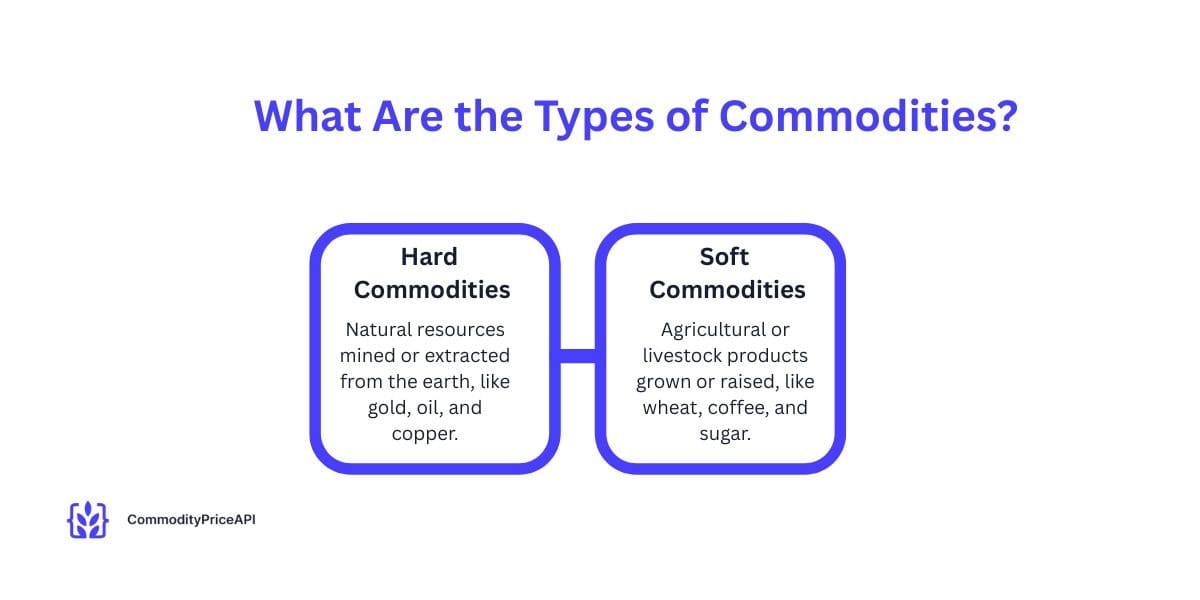

When it comes to their types, commodities have two major types:

- Hard commodities (oil, gold, metals)

- Soft commodities (coffee, corn, livestock).

You will learn more about these types in the coming sections.

How Commodities Function in the Market

As mentioned earlier, commodities form the economic backbone of a country; these are the essential goods and services that a country produces. Moreover, commodities play an important role in global production and trade.

Most importantly, commodities are traded on exchanges where sellers and buyers determine their prices based on supply and increasing demand dynamics.

- Producers, such as farmers or mining companies, sell commodities.

- Manufacturers, investors, and traders buy them for production or profit.

It is also important to know What Are Commodity Prices factors that influence the prices of commodity derivatives. These are:

- Weather

- Geopolitical events

- Global economy trends

There is one more thing. Traders also sign advance contracts for future trades. Futures contracts are helpful for them to lock in commodity price movements for future delivery. As a result, risk is significantly reduced.

Commodity Buyers and Producers: Roles and Strategies

Commodity buyers and oil producers use contracts to manage price risks. It means that both the buyers and sellers play a vital role in the commodity index.

Mining companies and farmers fall under the producer category. They sell the commodity futures contracts to fix the prices of their goods. The result? Financial stability, even if the market value lowers.

On the other hand, manufacturers and food companies purchase those futures to get a stable cost for agricultural commodities. They come under the buyers category.

Let's take an example. There is a wheat farmer. He will be selling the futures contracts on the Chicago Board of Trade (CBOT). Each wheat contract equals 5,000 bushels with specified grades on the Chicago Mercantile Exchange.

Upon termination of this contract, producers or buyers may receive or deliver the physical commodity. This indicates that both parties are protected from market volatility with stable prices.

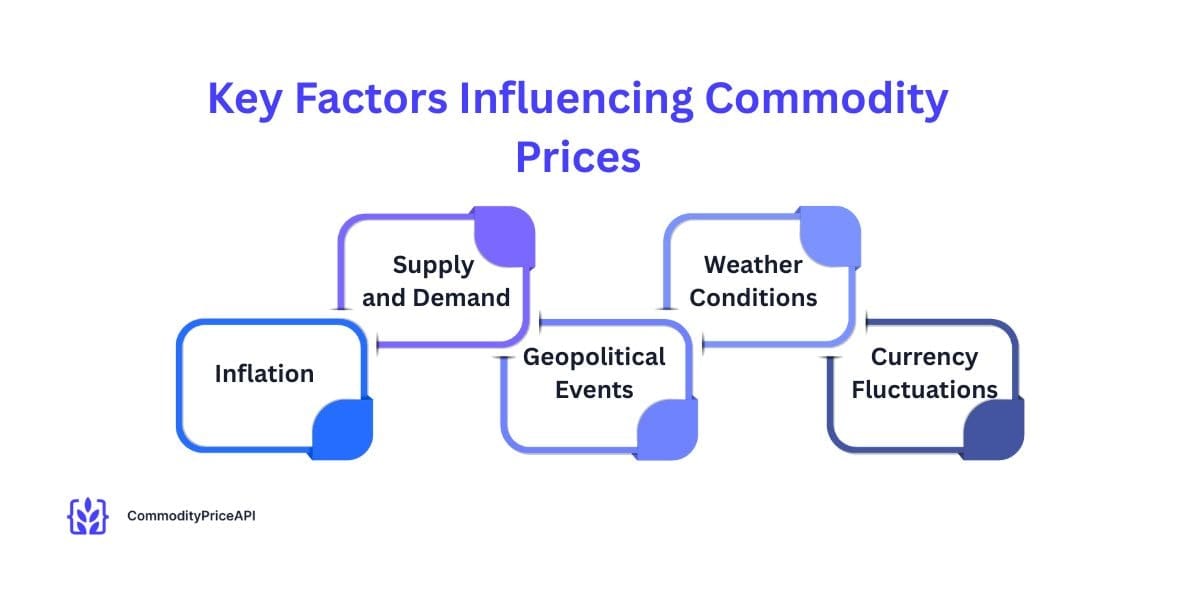

Key Factors Influencing Commodity Prices

So, What Are Commodity Prices factors that influence commodity exchange-traded funds.

1. Inflation

This is one of the key facts that investors use commodity investments as a secure hedge against declining currency value. The situation becomes prominent during inflation hedge.

2. Supply and Demand

Whenever there is a highly volatile demand for something, scarcity may occur. As a result, it also pushes the prices higher. Over supply of raw materials causes their reduction.

3. Geopolitical Events

Some factors also affect the supply chain, which causes a spike in prices. These several factors can be political instability, trade restrictions, and conflicts.

Conflicts, trade restrictions, and political instability can disrupt supply chains, causing price spikes.

4. Weather Conditions

Extreme weather conditions and natural disasters affect energy products and agricultural futures markets. As a result, we deal with higher prices.

5. Currency Fluctuations

It is important to note that most commodities are traded in U.S. dollars. If the dollar price is weaker, it can increase the price of a particular commodity.

Since most commodities are traded in U.S. dollars, a weaker dollar generally leads to higher global commodity prices.

What Determines Commodity Prices?

It is equally important to understand the factors that determine the prices of commodity markets. As previously discussed, supply and demand play a crucial role in determining commodity prices. As soon as the economy grows, there is a huge demand for commodities such as natural gas, oil, and wheat.

The supply and demand dynamics are also influenced by multiple factors. These can be:

- Economic disruptions

- Natural disasters

- Changing investor sentiment.

Let's suppose that anticipated inflation occurs in a country. Investors will start investing in the commodity markets as a protective hedge. As a result, demand for commodities increases, and prices also increase.

What Are Commodity Prices Types?

In the preceding sections, we provided an overview of the types of commodities traded. Let's dig into those types now:

Hard Commodities

Hard commodities refer to natural resources extracted or mined from the earth. These can include materials such as copper, silver, and gold. But that's not all. It also includes the energy commodities. For example, coal, oil, natural gas, and crude oil prices. We utilize these commodities in global trade, manufacturing, and the production of industrial metals. You can check real-time gold prices here.

Soft Commodities

Livestock or agricultural products that are raised or cultivated are known as soft commodities. Some examples include wheat, corn, cotton, coffee, sugar, cocoa, and soybeans. These commodities are heavily dependent on weather conditions.

Most importantly, their prices fluctuate more due to supply and demand factors. Environmental factors are also important here. If you want to know how to fetch real-time commodity prices, check out this guide.

Where to Check Live Commodity Prices?

There are multiple resources out there to check the live prices of futures, options, and forward contracts for precious metals and energy products. However, you need to rely on sources that give you reliable data for futures prices and mutual funds. Here are some options to get underlying commodities data:

Commodity Prices APIs

This option is considered the most reliable, as it provides frequent data updates sourced from trustworthy sources. Moreover, you can integrate the data easily within your apps. Your apps are always up to date, and customers are satisfied. However, ensure that you choose the right API. One such API is the commodity price API.

To stay informed about the ever-shifting market landscape with the commodity price API, click on this link.

Financial News and Data Sites

There are several websites, including Bloomberg, Reuters, and MarketWatch. They publish up-to-date commodity prices, market conditions and expert analysis. These platforms are ideal for traders, analysts, and investors who need accurate and timely information to make informed market decisions.

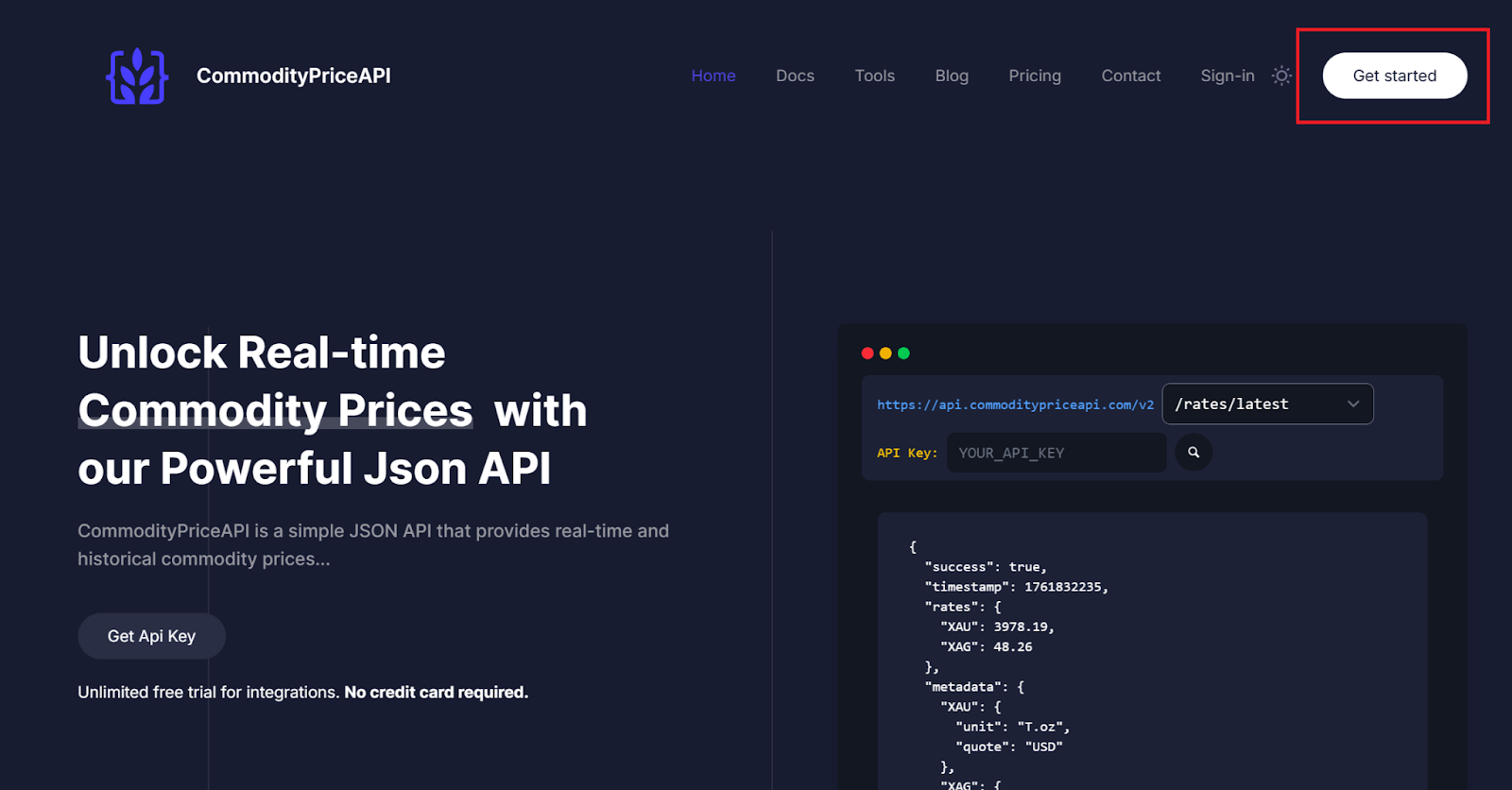

How to Use the Commodity Prices APIs?

To use the CommodityPrice API, navigate to the website: https://commoditypriceapi.com/

Click on the “Get Started” button.

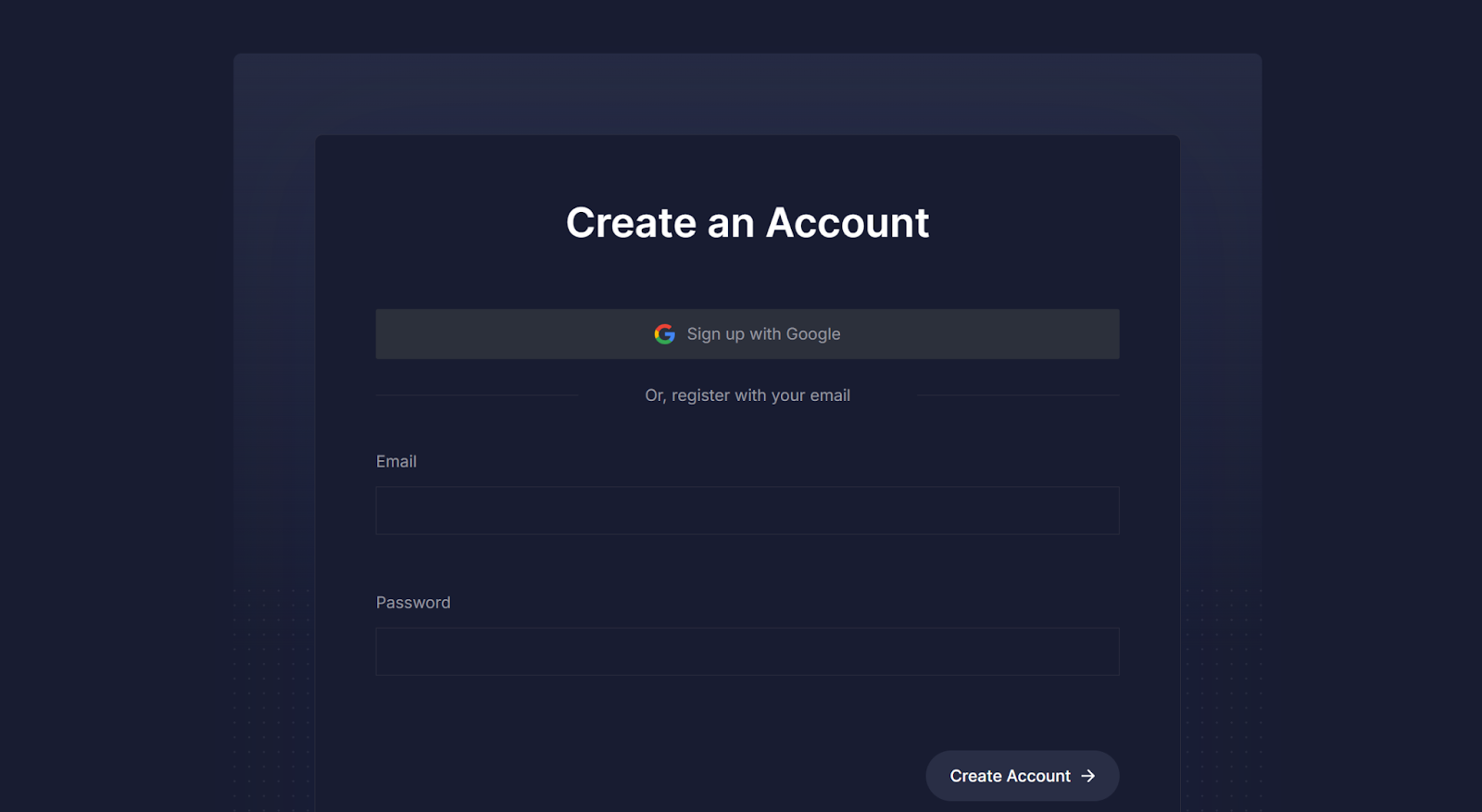

The next step is to create an account. You can also continue with Google:

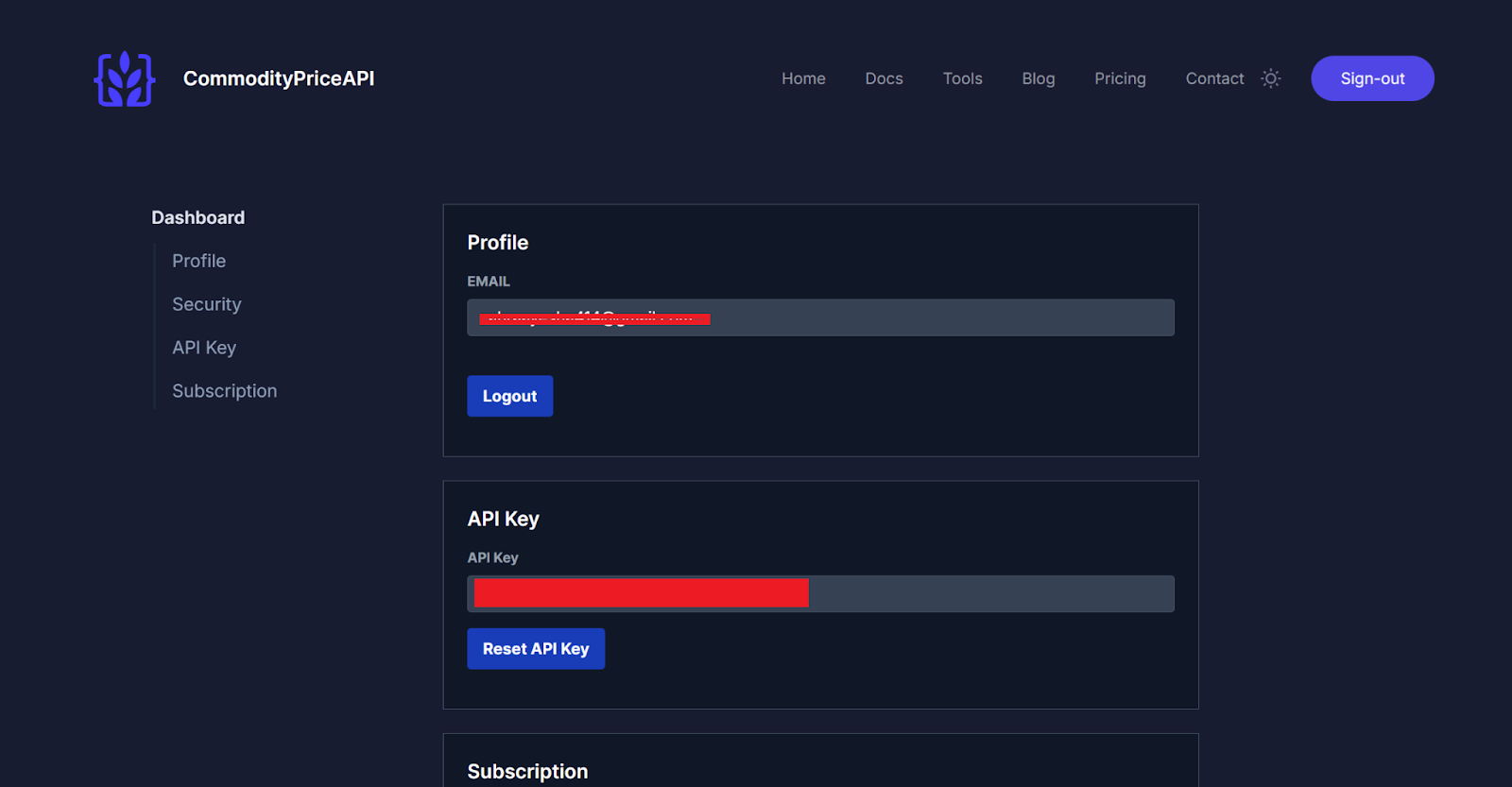

Check out the dashboard after logging in:

The next steps are simple. Just copy your API key and open the documentation page. You will be able to check different endpoints here:

Here are the endpoints offered by the Commodity Price API:

1) API usage information for your account.

$ curl https://api.commoditypriceapi.com/v2/usage -H "x-api-key: YOUR_API_KEY"2) Supported commodities (symbol, category, currency, unit, and name).

$ curl https://api.commoditypriceapi.com/v2/symbols -H "x-api-key: YOUR_API_KEY"3) Latest Rates Endpoint:

$ curl https://api.commoditypriceapi.com/v2/rates/latest?symbols=xau,wtioil \-H "x-api-key: YOUR_API_KEY"4) Historical Rates Endpoint:

$ curl https://api.commoditypriceapi.com/v2/rates/historical?symbols=xau,wtioil&date=2019-01-04 \ -H "x-api-key: YOUR_API_KEY"5) Timeseries Endpoint:

$ curl https://api.commoditypriceapi.com/v2/rates/time-series?symbols=xau,wtioil&startDate=2023-12-08&endDate=2023-12-13 \ -H "x-api-key: YOUR_API_KEY"6) Fluctuation Endpoint:

$ curl https://api.commoditypriceapi.com/v2/rates/fluctuation?symbols=xau,wtioil&startDate=2023-12-08&endDate=2023-12-13 \ -H "x-api-key: YOUR_API_KEY"Conclusion

Commodity prices have a significant influence on a country's economy. However, their prices keep fluctuating on a constant basis. This can be a significant impact for both sellers and buyers in commodity markets. Therefore, you need reliable data sources to obtain accurate and reliable commodity data more quickly.

This is where a commodity price API can be your best friend. You can choose a free plan to try it out. Plus, you can opt for a paid plan if you want advanced features. However, before choosing an API, it is essential to ensure that it aligns with your requirements.

FAQs

What Is Meant By Commodity Prices?

Prices of daily life materials such as oil, wheat, gold, and natural gas are referred to as commodity prices.

How Are Commodity Prices Determined?

Commodity prices are determined by supply and demand, the global economy, and production.

Why Do Commodity Prices Change So Often?

Investment, inflation, politics, and weather are some of the major drivers of commodity global markets.

What Are The Main Types Of Commodities?

The two main types of commodities are hard commodities and soft commodities. Hard commodities can be metals and energy(oil and natural gas). On the other hand, soft commodities can be crops.

Why Are Commodity Prices Important?

Commodity prices are the financial asset class that directly impacts physical product costs and global trade. and future cash flows.

Where Can I Check Live Commodity Prices?

You can check the prices of essential raw materials at CommodityPriceAPI.com for real-time, reliable JSON-based commodity price updates. Institutional investors use these APIs to reduce counterparty credit risk and bad market economic conditions.

What Is A Commodity Price API?

The commodity price api gives you fast data that can be historical as well as live in JSON format. It comes with a diversified portfolio of API endpoints.

How Can Businesses Use Commodity Price APIs?

Businesses use these APIs by integrating them within trading tools, financial problems, and data dashboards.

Are Commodity Prices Related To Currency Exchange Rates?

Yes. Commodities are priced in dollars, so shifts in the currency affect global price movements.

Which Factors Most Affect Global Commodity Markets Today?

Economic factors such as inflation, supply chain issues, geopolitical tensions, and investor activity drive major changes.

Sign up today at the Commodity Prices API to get the best commodities data.