Best Use Cases Of API Commodities In Finance, ERP, And Supply Chain Apps

Ejaz Ahmed

10 Dec 2025 • 9 min read

Introduction

Have you ever imagined why global manufacturers are struggling to forecast prices? Because the prices of oil change overnight. Rates of metals fluctuate within the hour. The prices or data changed suddenly, and the teams are busy fixing their spreadsheets and changing their budget.

Because of this, the supply chain and finance decisions lag behind the real market movements. Because of this delay, companies miss opportunities in global markets.

In a modern digital world, businesses need what? They need insights in real-time. Commodity prices API impacts the operations of the supply chain, ERP systems, and finance. Having correct information is an important factor; it's not something you miss or ignore.

The CommodityPriceAPI helps you with all these things. They give you real-time prices and historical prices for 130+ API commodities. Their supported free commodities API includes:

- Wheat

- Corn

- Natural gas

- Crude oil

- Silver

- Gold

They give you fast integrations, a trusted data source, and the best pricing plan that is best for finance, ERP, and your supply chain apps. In this blog, we will talk about what is commodities api free resources are and why they are important, and how to use them effectively. Let’s get started.

What Are API Commodities

The free commodity API is a digital interface that gives you the prices of the commodity market API via endpoints. It works smoothly with different programming languages and lets you integrate API endpoints easily. They gives developers access to:

- Historical trendsgive

- Metadata

- Latest rates

API for commodity prices gives you details, such as quote currencies, units of measurement, and timestamps. It allows developers to gain the data programmatically without manual effort.

For example:

The current rates endpoint can fetch symbols. Such as XAU for gold, XAG for silver, WTI OIL, and NG FUT is used for natural gas. Did you know what developers use to authenticate the request?

They use an API key to authenticate the request. Integration takes only a few minutes and displays the accurate commodity prices API in real-time. This includes essential details such as the opening price and closing price.

Why Businesses Need API Commodities Price

Businesses need a real-time commodity data API, which is fast, accurate, and decision-making. Real-time prices help you improve the forecasting. Teams can easily automate the workflow, reducing errors in the spreadsheet. Correct data enhances two things: dashboards and reporting.

Historical and time series data help you to analyze trends and plan long-term business strategies. Custom quotes and currencies simplify the global operation. Teams that are in different countries can see the data in their local currencies without manual effort.

As a result, commodity APIs help businesses to respond faster, optimize costs, and improve their efficiencies.

If you want to learn about Gold price news, then read this blog, Latest Gold Price News: May 2024 Update.

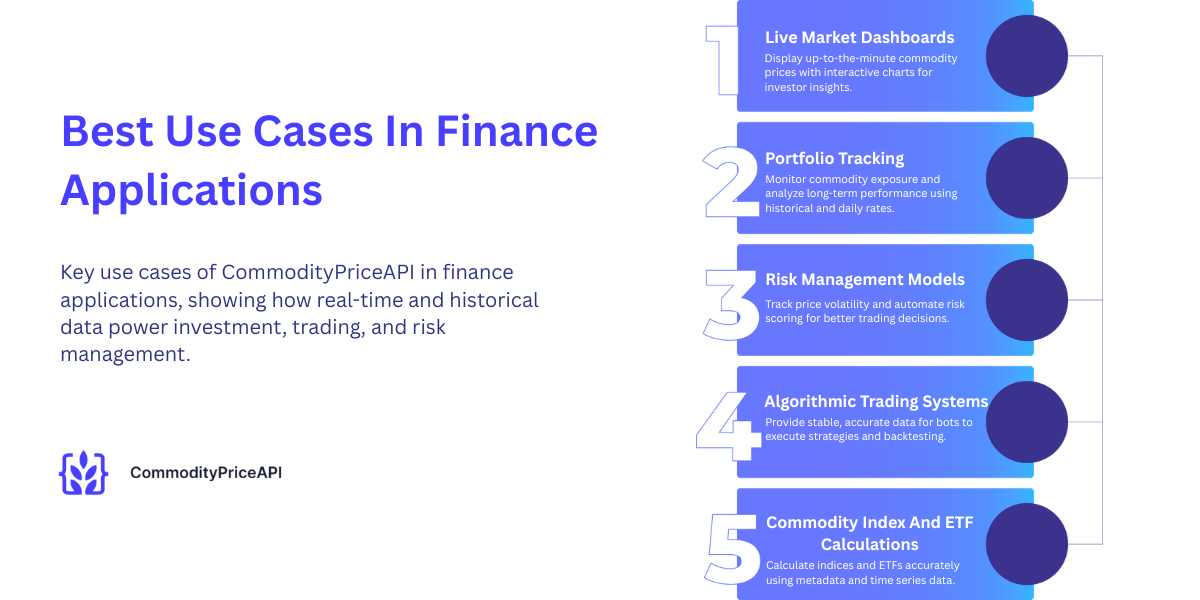

Best Use Cases In Finance Applications

Live Market Dashboards

Financial apps need real-time data for their feeds to display the prices of gold, silver, gas, and oil. CommodityPriceAPI free to help you with all these things. They update the live prices every sixty seconds only for their premium users.

Because of this, developers can easily create interactive charts by using the latest rates endpoint. This thing gives investors up-to-the-minute insights.

Portfolio Tracking

Investors track the prices of commodity exposure across portfolios. Up-to-date rates give you a snapshot of positions. Historical data gives you long-term performance analysis. This helps users to identify the trends and make the best decisions.

Risk Management Models

Risk management is very important for trading strategies. APIs give you fluctuation data and also time series analysis. Finance teams can automate risk scoring and monitor day-to-day commodity prices.

Algorithmic Trading Systems

Trading bots depend on correct and consistent data. CommodityPriceAPI gives you stable pricing from the trusted commodity exchange API. Bots automate the trading programs. They follow some rules you set for when to buy and when to sell.

They look at the exact price each time when the price changes. Then they test your rules very accurately, and then they give the result with a proper strategy.

Commodity Index And ETF Calculations

Index and ETFs use API commodities such as:

- Oil for benchmarks

- Silver

- gold

All you need is basic details, like (kg, barrel, ton), and the currency, such as USD or EUR, to calculate the values correctly. Also, you need past price data so you can update the index on time and check how it performed.

Best Use Cases In ERP Systems

Real Time Costing

Teams of manufacturing and production need the correct and accurate cost of materials. APIs feed ERP systems with current prices of:

- Raw materials

- Energy

- Precious Metals

These thing reduces the cost of leakage and ensure the pricing and accuracy in bills of materials.

To know the information about the market landscape, read this blog: Navigate the Ever‑Shifting Market Landscape with CommodityPriceAPI.

Procurement Planning

Commodity price fluctuations impact the procurement. The system of ERP tracks the prices. It increases or decreases the prices for corn, wheat, copper, natural gas, and crude oil. Teams plan purchases when rates align with their needs.

Budgeting And Forecasting

Historical price data gives information to ERP forecasting models. The time series endpoint gives daily prices up to a year. Teams can easily forecast the budget requirements more effectively.

Vendor Management And Contracting

Contracts of vendors sometimes link to commodity indices. APi will update the contact with the latest rates. This thing ensures fair terms for both the buyer and the supplier.

Financial Reporting

All current commodity prices are pulled by ERP modules for cost and revenue reports. The worldwide team can view the financial data in their local terms because of bespoke quote currencies. Automation increases accuracy and decreases the amount of manual spreadsheet effort.

Best Use Cases In Supply Chain Applications

Inventory Optimization

Teams of supply chain monitor the prices of API commodities to set replenishment triggers. Falling prices signal replenishment opportunities. Rising prices prompt inventory reduction or demand reshaping.

Logistics And Freight Cost Calculation

Fuel costs directly affect logistics. Real-time WTI and Brent rates help to calculate transportation charges. Natural gas prices assist in planning heating and process needs.

Demand Forecasting

Commodity prices are in demand, especially for metals, grains, and energy. Historical data feeds machine learning models to improve their forecast accuracy, reducing stockouts and overstocking.

Supplier Negotiation Tools

Transparency in commodity prices is very important for negotiations. Apps of supply chain benchmark supplier offers against the latest market rates. Because of this, teams avoid overpaying during these volatile periods.

Production Scheduling

Manufacturers adjust production in response to changes in raw material prices. APIs give scheduling around price dips and spikes. It optimizes the cost efficiency.

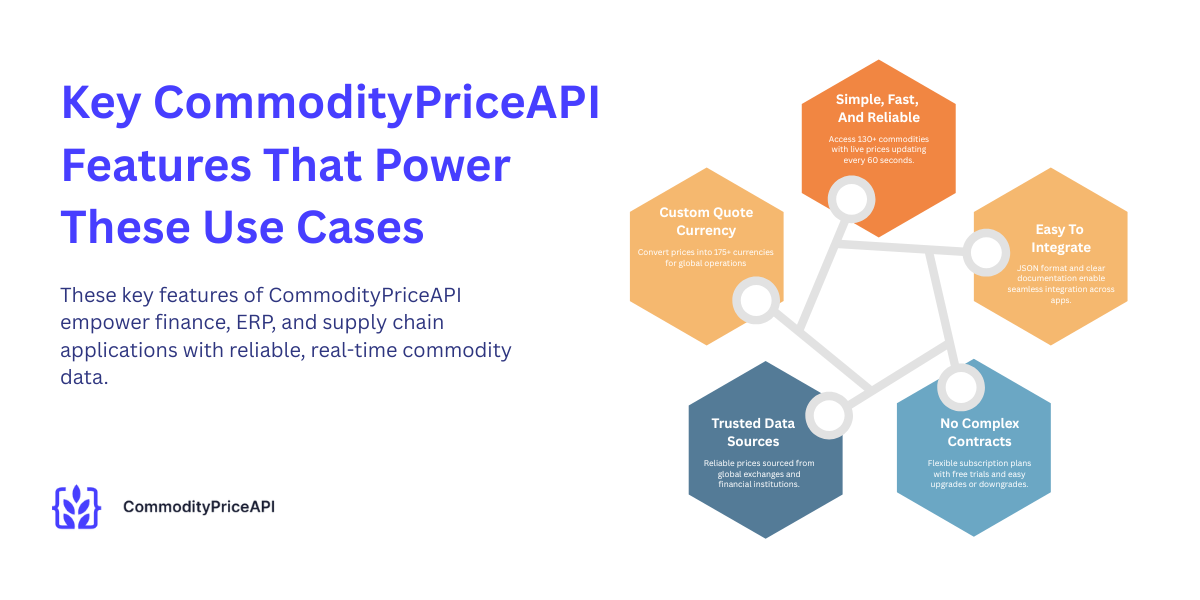

Key Commodity Price API Features That Power These Use Cases

Simple, Fast, And Reliable

It gives you 130+ API commodities, which include:

- Agricultural commodities

- Energy

- Metals.

It gives you the latest price updates every 60 seconds. This feature is only for Plus and Premium users.

Easy To Integrate

It gives you fast integration and a clear document in JSON format. It supports time series. Historical rates, quote currencies, and symbols. This works better with finance apps, an ERP system, and platforms like supply chain.

Want to fetch real time prices, then read this blog of CommodityPriceAPI, How to Fetch Real Time Commodity Prices.

No Complex Contracts

It has flexible monthly and yearly plans. A free trial is available without a credit card. You can upgrade it any time, and the same for the downgrade.

Trusted Data Sources

The data comes from global exchange rates and financial institutions. Teams depended on accurate and consistent pricing analysis and reporting.

Custom Quote Currency

It supports 175 currencies. So the teams can easily convert prices to their local currencies.

How Developers Integrate CommodityPriceAPI

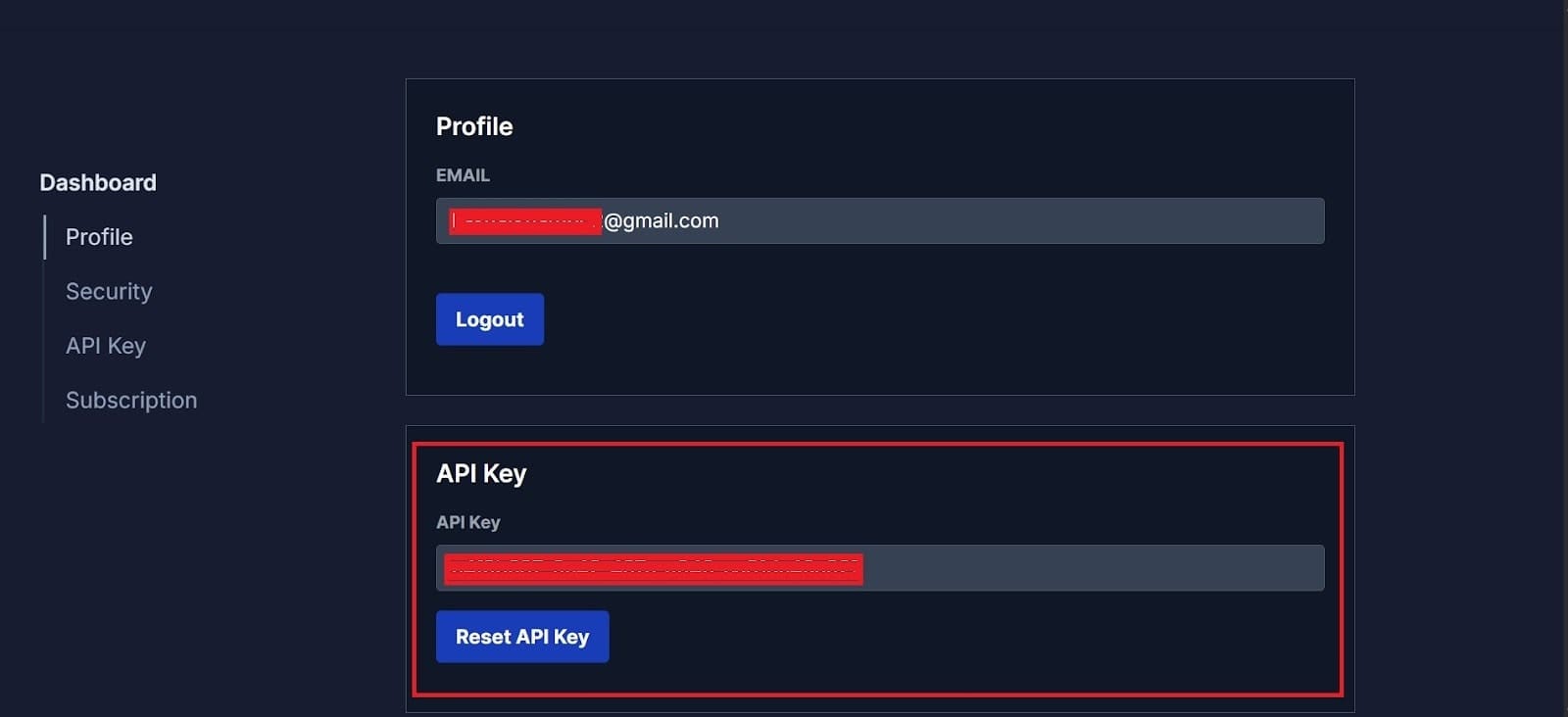

Get API Key

First, sign in with CommodityPriceAPI.

After signing in, you will get your API key immediately.

Keep your API keys secure and avoid exposing them in front of your client or anyone.

Call The Latest Rates Endpoint

Here is the example of gold, silver, and oil endpoint:

https://api.commoditypriceapi.com/v2/rates/latest?symbols=XAU,XAG,WTIOIL-FUT&apiKey=YOUR_API_KEYExample Response:

{

"success": true,

"timestamp": 1703866777,

"rates": {

"WTIOIL-FUT": 72.29,

"XAU": 2066.98

},

"metaData": {

"XAU": {

"unit": "T.oz",

"quote": "USD"

},

"WTIOIL-FUT": {

"unit": "Bbl",

"quote": "USD"

}

}

}Use Historical And Time Series Endpoints

Fetch historical data back to 1990. Make charts, trend lines, and automated reports.

https://api.commoditypriceapi.com/v2/rates/historical?symbols=xau,wtioil-fut&date=2019-01-04%22%20-H%20%22x-api-key:%20YOUR_API_KEY Example Response:

{

"success": true,

"date": "2019-01-04",

"rates": {

"XAU": {

"date": "2019-01-04",

"open": 1295.17,

"high": 1298.49,

"low": 1276.6,

"close": 1284.81

},

"WTIOIL-FUT": {

"date": "2019-01-04",

"open": 46.9,

"high": 49.22,

"low": 46.65,

"close": 47.96

},

"TEAM": {

"date": "2025-04-01",

"open": 0,

"high": 0,

"low": 0,

"close": 2.11

}

}

} Monitor Usage

Track your quota and monthly usage through the dashboard to ensure smooth operations.

API Commodities Endpoint Table

|

Endpoint |

Description |

Supported Symbols |

Use Case |

|

Latest Rates |

It fetches the current commodity prices |

All supported API commodities symbols |

Live dashboards, portfolio tracking |

|

Historical Rates |

It retrieves the prices on a specific date |

All supported API commodities symbols |

Budgeting, reporting, and trend analysis |

|

Time Series |

It fetches daily prices, but it has some range |

All supported API commodities symbols |

Forecasting, index calculations |

|

Fluctuation |

It tracks the prices that change over time |

All supported API commodities symbols |

Risk management, procurement planning |

|

Symbols |

It lists all the supported commodities |

N/A |

Integration, development reference |

Best Practices For Using Commodity APIs In Apps

Use server-side calls to protect your API commodities keys. Results of the cache improve the performance. Monitor the rate limits and also validate the date format. It combines real-time and historical data for the best insights. Custom quotes and currencies help teams to work smoothly

2024 Commodity Prices Outlook: A Detailed Analysis

TL;DR

API commodities gives you the prices in real-time and historical both. It gives prices for 130+ API commodities, including gold, oil, metals, and grains. Finance apps use commodity prices for live dashboards,tracking for portfolio, trading automation, and risk models. ERP system benefits from them; they get accurate costing, planning of procurement, budgeting, and management of vendors.

Supply chains optimize the inventory and other things like logistics, demand forecasting, and production scaling by using API commodities data and supplier negotiations. Developers integrate via JSON responses endpoints with historical, fluctuation, and time series data. With the fast updates, businesses can reduce the risks.

Conclusion

API commodities transform some applications, such as ERP and supply chain. They work the same way whether you’re tracking live cattle futures, heating oil, palm oil, or any given commodity.

It gives you real-time and historical data. This includes live data on volume, lowest price, highest price, and even energy products like coal and platinum.

This improves decision-making and reduces risks. It also automates workflows using the latest endpoint for any query.

API commodities provide speed and accuracy. They offer a default simple integration for over 130 global commodities.

FAQs

What Is API Commodities?

It is a digital interface providing live and historical commodity prices.

How Does CommodityPriceAPI Deliver Real-Time Prices?

With the help of a secure endpoint, you can use your API key.

Which Commodities Can I Access?

You can access gold, silver, crude oil, natural gas, and wheat.

Can I Convert Prices Into Different Currencies?

Yes, it supports 175 quote currencies.

How Do I Get My API Key?

First, sign up, and after that, you will get your API key immediately.

Does The API Support Historical Rates?

Yes, historical data is available from the 1990s.

How Often Do Rates Update?

Plus and premium plans give you updates every 60 seconds.

Can I Integrate The API Into ERP Systems?

Yes, it works with:

- Supply chain apps

- Finance

- ERP

What Is The Rate Limit For Each Plan?

Your limit depends on which subscription plan you purchased.

Is There A Free Commodity Price API?

Yes, this free API for commodity prices has no need for a credit card. The free commodity prices API is helpful for checking the app.